Ethics and Professional Standards

1. Ethics and Trust in Investment Profession, 2. Code of Ethics & Standards of Professional Conduct

Basics:

Ethics: Set of moral principles / rules of conduct providing guidance for behavior

Moral / ethical principles: beliefs on good / acceptable / obligatory VS bad / unacceptable / forbidden

Ethical conduct: behavior following moral principle / balances self-interest w in/direct consequences on other

Code of Ethics: Established general guide on org’s value / overall expectation regarding member behavior

Standards of Conduct: Established minimally acceptable / benchmark behaviors required by group enhancing Code of Ethics

Profession (1) are subject to license / technical standard (2) aim to serve society, set / enforce professional conduct

Professions build trust as they (1) normalize practitioner behavior (2) provide service (3) are client focused [fiduciary duty acting in best interest for another party] (4) have high entry std (5) possess expert knowledge [knowhow & synergy] (6) encourage continuing education (7) monitor conduct (8) are collegial / respectful (9) recognize oversight bodies (10) encourage member engagement (11) evolve (12) are professional (13) trust investment mngmnt [full disclosure]

Client interest < market interest

CFA Institute Global Body of Investment Knowledge (GBIK) and Candidate Body of Knowledge (CBOK) are updated thru practice analysis (interaction w practicing investment mngmnt professionals) to maintain body of knowledge relevant

CFA charterholders and CFA Program candidates are required to adhere to Code and Standards and to sign annually a statement attesting to that continued adherence

Investors w low levels of trust are less willing to accept risk and will likely demand a higher return for use of their capital

Investment management profession and investment firms must be interdependent to maintain trust

Challenges:

Overconfidence: too much emphasis on internal trait / intrinsic motivation

situational influence: money, prestige, loyalty

Legal vs ethical: Ex. trading w material nonpublic info - ok legally, unethical in CFA

Ethical Decision-Making Framework

Identify: Relevant facts (fact / opinion / bias) stakeholders and duties owed, ethical principles, conflicts of interest

Consider: Situational influences, additional guidance, alternative actions

Decide and act

Reflect: Was the outcome as anticipated? Why or why not?

Guidance:

Standards of Practice Handbook (Handbook) guides ethical dilemmas which all members must adhere to

CFA Institute Bylaws and Rules of Procedure for Professional Conduct (Rules of Procedure) structure the Code and Standards

CFA Institute Board of Governors oversee Professional Conduct Program (PCP). PCP and Disciplinary Review Committee (DRC) enforces Code and Standards. DRC reviews conduct and partners with Professional Conduct (PC) staff to establish / review professional conduct policies. PC division enforces test policies and professional conduct of Certificate in Investment Performance Measurement (CIPM). CFA Institute Standards of Practice Council evaluates Code and Standards and Handbook, ensuring they are effective (representative of high standards, relevant, applicable, comprehensive, enforceable, testable)

PC inquiries:

Source: (1) self disclosure on annual PC Statement - litigation, investigation (2) written complaint received by PC staff (3) media, regulatory notice, public source (4) proctors monitoring test (5) score analysis to detect disclosure of confidential exam info

Conduct interviews / investigation

Result: no disciplinary action, issue cautionary letter, continue proceedings to discipline member

Rejection or acceptance by members. If rejected, matter referred to DRC

Sanctions include public censure, suspension of member / use of CFA design, revocation of CFA

Code of Ethics:

Act w integrity, competence, diligence, respect and ethically w public, clients, prospective clients, employers, employees, colleagues in investment profession, other participants in global capital markets

Place integrity of investment profession, interests of clients above own personal interests

Use reasonable care, exercise independent professional judgment when conducting investment analysis, making investment recommendations, taking investment actions, engaging in other professional activities

Practice, encourage others to practice professional, ethical manner reflecting credit on themselves, profession

Promote integrity, viability of global capital markets for the ultimate benefit of society

Maintain, improve professional competence, strive to maintain, improve competence of other investment professionals

Standards of Professional Conduct: (Revisions of 11th version underlined) in Standards of Practice Handbook

Professionalism

Knowledge of the Law

Members must understand / comply w all applicable laws, rules, regulations (Code & Standard) of any gov, regulatory organization, licensing agency, professional association governing their professional activities. In event of conflict, Members must comply with the more strict law, rule, regulation. Members must not knowingly participate / assist in and must dissociate from any violation of such laws, rules, or regulations.

→ (1) attempt to stop behavior by bringing it to attention of employer thru supervisor / compliance department. (2) members dissociate from activity (removing own name in written reports, asking for dif assignment, refusing to accept new client / continue current)

→ if using photocopy of paid textbook, both user and provider are in violation

Independence and Objectivity (VS VI (A) Disclosure of Conflict)

Members must use reasonable care, judgment to achieve, maintain independence and objectivity in professional activities. Members must not offer, solicit, accept any gift, benefit, compensation, consideration that reasonably could be expected to compromise their own or another’s independence and objectivity.

→ allocation of shares in oversubscribed IPOs to investment managers for their personal accounts is prohibited

→ If possible, disclose gifts before accepting, and if impossible, disclose to employer benefits

→ To miniminze pressure from IB, use (1) enhanced firewall: separate reporting structures for personnel on research & IB side (2) good compensation for research analysts (3) comp’s regular policy review to safeguard analysts

→ If pressure by comp to change rating, place comp on restricted list, give facts only ab comp

Misrepresentation

Members must not knowingly make any misrepresentations relating to investment analysis, recommendations, actions, other professional activities.

Misconduct

Members must not engage in any professional conduct involving dishonesty, fraud, deceit or commit any act that reflects adversely on professional reputation, integrity, competence.

Integrity of Capital Markets

Material Nonpublic Information

Members who possess material nonpublic info that could affect the value of investment must not act or cause others to act on the info

→ Mosaic theory: use non/material non/public info to create larger picture, and conclusion becomes material after assembled

→ Build firewall to keep material nonpublic info

→ If hear material nonpublic info on security, place it on restricted list - you can not act on it even if personal account

Market Manipulation

Members must not engage in practices that distort prices, artificially inflate trading volume w intent to mislead market participants.

Duties to Clients:

Loyalty, Prudence, and Care

Members have a duty of loyalty to their clients, must act with reasonable care and exercise prudent judgment. Members must act for the benefit of their clients, place their clients’ interests before their employer’s or their own interests.

→ soft commission policy: members are required to only use client brokerage to the benefit of the clients

Fair Dealing

Members must deal fairly, objectively w all clients when providing investment analysis, making investment recommendations, taking investment action, engaging in other professional activities.

Suitability

When Members are in an advisory relationship with a client, they must:

Make a reasonable inquiry into a client’s or prospective client’s investment experience, risk and return objectives, financial constraints prior to making any investment recommendation, taking investment action and must reassess, update this info regularly.

Determine that an investment is suitable to the client’s financial situation and consistent with the client’s written objectives, mandates, constraints before making an investment recommendation or taking investment action.

Judge the suitability of investments in the context of the client’s total portfolio.

When Members are responsible for managing a portfolio to specific mandate, strategy, style, they must make only investment recommendations or take only investment actions that are consistent with the stated objectives and constraints of the portfolio.

Performance Presentation

When communicating investment performance info, Members must make reasonable efforts to ensure it is fair, accurate, complete.

→ Standards do not require compliance with GIPS, auditing, verification requirements

Preservation of Confidentiality

Members must keep info about current, former, prospective clients confidential unless:

Info concerns illegal activities of prospective / client,

Disclosure is required by law,

Prospective / client permits disclosure of the info.

→ in case illegal activity detected: seek guidance from employer → legal counsel → resign

Duties to Employers

Loyalty

In matters related to their employment, Members must act for the benefit of their employer and not deprive their employer of the advantage of their skills and abilities, divulge confidential info, or otherwise cause harm to their employer.

→ In case member enters into independent biz while still employed, members must notify and earn consent of employer, describe type of service rendered, expected education of service, compensation for the services

→ soliciting clients is strictly prohibited when leaving a comp unless the solicited is unemployed

Additional Compensation Arrangements

Members must not accept gifts, benefits, compensation, consideration that competes with or might reasonably be expected to create a conflict of interest with their employer’s interest unless they obtain written consent from all parties involved.

Responsibilities of Supervisors

Members must make reasonable efforts to ensure that anyone subject to their supervision or authority complies w applicable laws, rules, regulations, Code and Standards.

→ if member cannot fulfill supervisory responsibilities due to absence of compliance system, member should decline in writing to accept supervisory responsibility until firm adopts reasonable procedures to allow member to exercise responsibility

Investment Analysis, Recommendation, and Actions

Diligence and Reasonable Basis

Members and Candidates must:

Exercise diligence, independence, thoroughness in analyzing investments, making investment recommendations, taking investment actions.

Have a reasonable, adequate basis, supported by appropriate research, investigation, for any investment analysis, recommendation, action.

→ Selecting External Sub/advisor: (1) reviewing adviser’s established code of ethics, (2) understanding adviser’s compliance, internal control procedures, (3) assessing qual of published return information, (4) reviewing the adviser’s investment process and adherence to its stated strategy.

Communication with Clients and Prospective Clients

Members and Candidates must:

Disclose to prospective / clients the basic format and general principles of investment processes they use to analyze investments, select securities, construct portfolios and must promptly disclose any changes that might materially affect those processes.

Disclose to prospective / clients significant limitations, risks associated w investment process.

Use reasonable judgment in identifying which factors are important to their investment analyses, recommendations, actions and include those factors in communications with prospective / clients.

Distinguish between fact, opinion in presentation of investment analysis, recommendations.

Record Retention

Members must develop, maintain appropriate records to support their investment analyses, recommendations, actions, other investment-related communications with prospective / clients.

Conflicts of Interest

Disclosure of Conflicts

Members must make full and fair disclosure of all matters that could impair their independence and objectivity or interfere with respective duties to their prospective / clients, employer. Members must ensure that such disclosures are prominent, are delivered in plain language, communicate the relevant info effectively.

→ If my senior is a board of subsidiaries of comp I write a research on, I disclose the relationship

→ If I write a research about comp A, and my comp holds stock of A, I need to disclose. No need to disclose I purchsed A stocks, or my brother is a supplier to A

Priority of Transactions

Investment transactions for clients and employers must have priority over investment transactions in which a Member is the beneficial owner.

Referral Fees

Members must disclose to their employer, prospective / clients, as appropriate, any compensation, consideration, benefit received from or paid to others for the recommendation of products or services.

→ disclosure allows client / employer to evaluate (1) any partiality shown in any recommendation of service (2) full cost of service.

Responsibilities as a CFA Institute Member / Candidate

Conduct as Participants in CFA Institute Programs

Members must not engage in any conduct that compromises the reputation or integrity of CFA Institute or the CFA designation or the integrity, validity, security of CFA Institute programs.

Reference to CFA Institute, the CFA Designation, and the CFA Program

When referring to CFA Institute, CFA Institute membership, the CFA designation, or candidacy in the CFA Program, Members must not misrepresent or exaggerate the meaning or implications of membership in CFA Institute, holding the CFA designation, or candidacy in the CFA Program.

→ O: I enrolled in the CFA Program to obtain the highest set of credentials in the global investment management industry.” “I Passed level 3 CFA exam”

→ “Chrissy is a CFA,” partial designation, “I got the highest score in the test”

** Party / nonmember / fim can claim compliance w CFA Institute Code & Standard once they have ensured that their code and ethics meets the principles of the Code and Standards.

4. Global Investment Performance Standards (GIPS)

Mission: promote ethics and integrity and instill trust through the use of the GIPS standards by achieving universal demand for compliance by asset owners, adoption by asset managers, support from regulators for the ultimate benefit of the global investment community.

Objective:

Promote investor interests, instill investor confidence.

Ensure accurate, consistent data.

Obtain worldwide acceptance of a single standard for calculating, presenting performance.

Promote fair, global competition among investment firms.

Promote industry self-regulation on a global basis.

Any firm that manages actual asset may comply. Firm must create, maintain composites for all strategies which firm manages segregated accounts. Firm must include all actual fee-paying, discretionary segregated accounts in at least one composite defined by (the same) investment mandate, objective, or strategy. Pooled funds must also be included in any composite for which the pooled fund meets the composite definition. This prevents cherry-picking

→ no non-discretionary segregated account, non-feepaying account

Verification: must be performed firm-wide. Compliance is claimed by comp, but verification by 3rd party

Composition (FICCDPRPW)

Fundamentals of compliance: Use “in accordance,” “in compliance,” “consistent.” Provide a compliant description of the past 12 months to all prospective clients. The firm may select its sub-advisor, but all total firm assets must be assigned to the sub-advisor

Input data

Calculation methodology

Composite construction

Disclosure: Performance / policies adopted by firm

Presentation and reporting

Real estate: not including publicly traded real estate securities, CMBS, private debt investment, frequency of external valuation

Private equity

Wrap Fee / Separately Managed Account (SMA) portfolios

** 6~9 are not under required provisions

The minimum effective compliance date for a wrap fee composite is 1 January 2006

• 1 January 2006 for real estate and private equity composites and pooled funds, as well as wrap fee composites.

• 1 January 2000 for all other composites and pooled funds.

Firm must maintain a list of composite descriptions and include terminated composites on this list for at least 5 years after the composite termination date. A complete list of pooled fund descriptions for limited distribution pooled funds is also required. A complete list of broad distribution pooled fund names only, but not the descriptions, is required. Firms are not required to include terminated limited or broad distribution pooled funds on the list.

Requirements:

The firm must present GIPS compliant record of a min 5 yrs of annual investment performance. If existent for less than 5, must present performance since inception. Afterwards, present additional year performance for each year to min 10 yrs

Firms may internally self-regulate, but should hire a 3rd party to perform legitimate composite testing and have local sponsoring org for effective investment performance standards.

Must comply to consistent data import and have blackout period (3 days employees not allowed to make alterations to a big retirement / investment plan), pre-clearance (obtain clearance – approval – before making the trade)

Recommend to input office locations, not overcrowd participation in IPO

Quantitative Methods

1. Rates and Returns

2. Time Value of Money

ROR = YTM = I/Y, discount rate = int rate, coupon = PMT

Annuity [finite, level CF / PMT]:

Ordinary annuity: CF indexed at t = 1 (end of payment period, usual format)

Annuity due: CF indexed at t = 0

Continuous compounding: FV = PV erN with N standard 1 year

Perpetual bond [infinite]: PV = PMT/(rs/m)

Constant dividend: PVt = Dt/r

Constant / Gordon Growth DDM Model : [Same as Cost of Equity’s V0]

PVt = Dt(1+g)r-g = D1r-g

Assumptions: (1) Div is correct metric for valuation (2) Div growth / Required ROR forever (3) Div growth rate < Required ROR

For insensitive to biz cycle, mature growth phase

Ex. electric utility serving a slowly growing area or a producer of a staple food product

* Cost of Equity V0 = D0(1+g)r-g = D1r-g

* WACC: re = D1P0 (1-f) + g

Multi-stage growth model:

PVt =(1) i=1nDt (1+gs)i(1+r)i + (2,3) E(St+n)(1+r)n where E(St+n) = Dt+n+1 (r-gl)

(1) ST Div Cost: find ∑(individual ST Div cost)

(2) LT Div Cost: find E(St+n) = terminal value = stock value of the stock in n periods: [Dt+1 (1 + LT growth)] / (r-gl)

(3) (2) / (1+r)n

(4) add (1) and (3)

For rapidly growing companies

* Cost of Equity V0 = t=1nD0(1+gs)t(1+r)t + Vn(1+r)n , where Vn Dn+1r-gL , Dn+1 = D0 (1+gs)(1+gL)

Price to Earning ratio

Price to Earning ratio = pr-g, p = Div Payout Rate

As PVt = Dt (1+g)r-g=> PVtEt = Dt (1+g) / Etr-g

Forward price to earning ratio: = Expected div payout ratior-g

As PVtEt+1 = Dt+1 (1+g) / Et+1r-g

Different CF: Find NPV, and compare to other investment’s PV

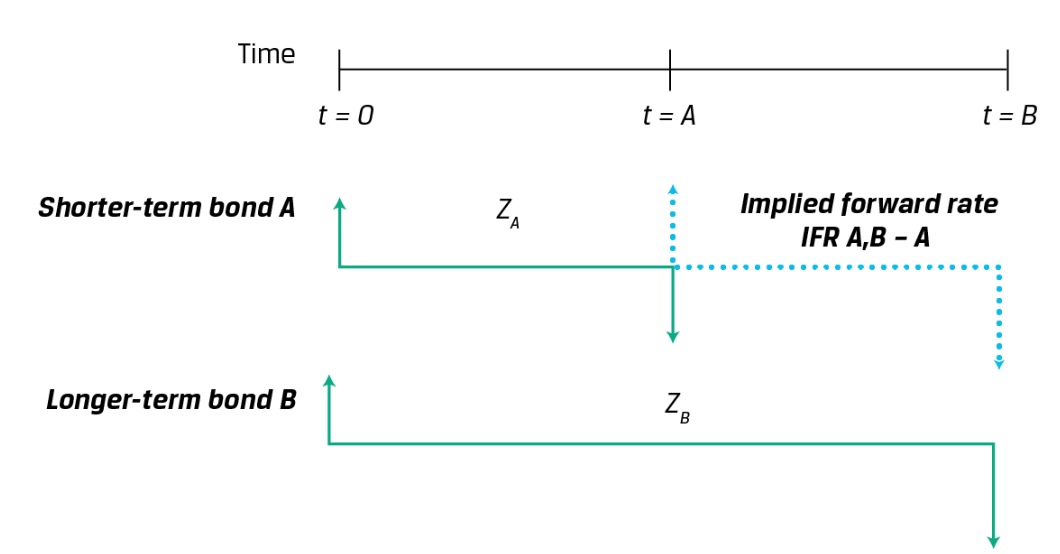

Two Rf bonds: F1,1 = (1+r2)2/(1+r1) -1

As FV2 = PV0(1+r2)2 = PV0(1+r1)(1+F1,1)

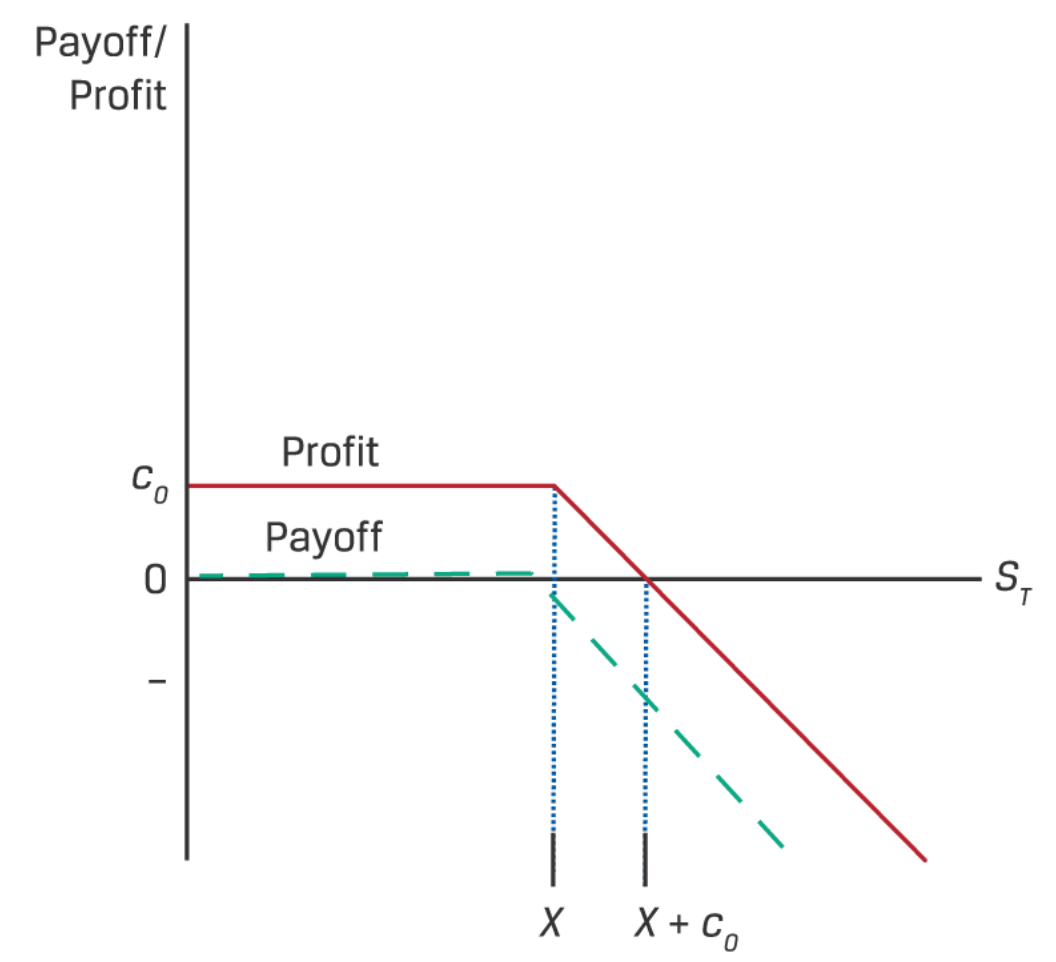

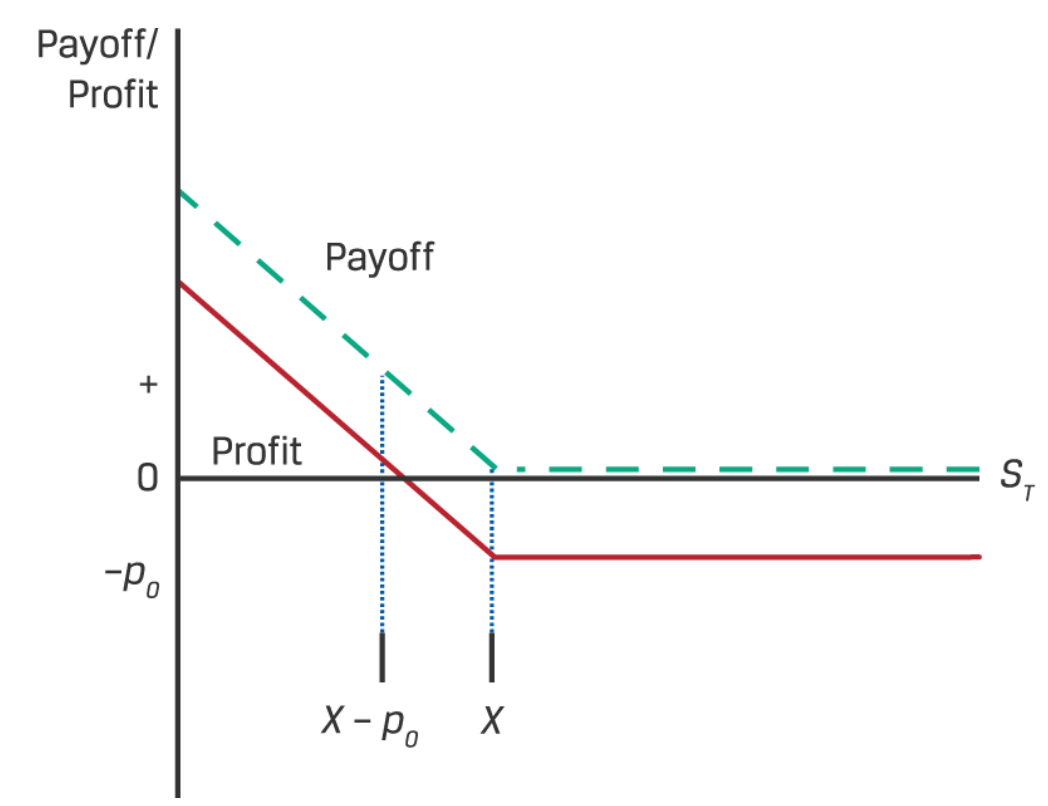

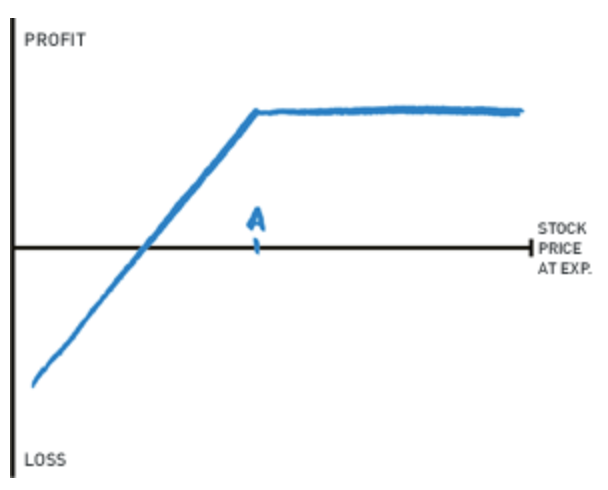

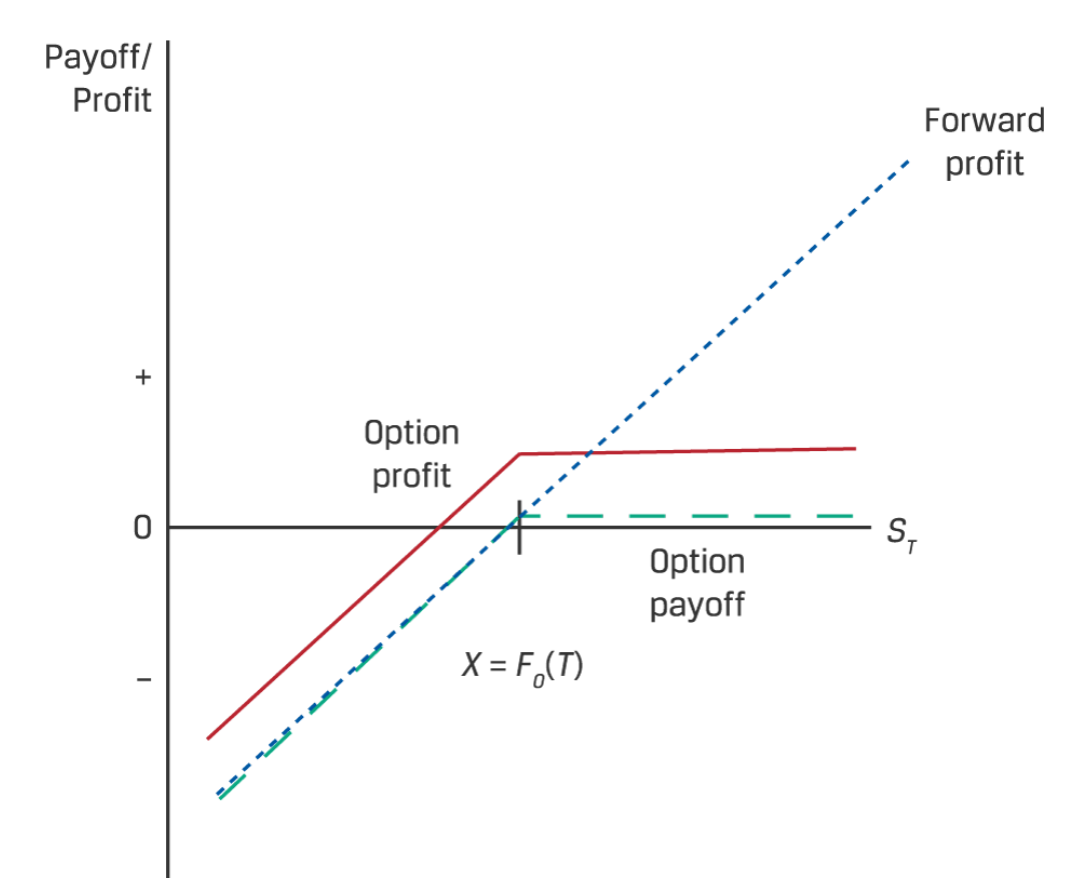

Options

V0 = (hedge ratio) S0 - c0 = Vu1+r = Vd1+r

Hedge ratio: Proportion of underlying offsetting risk associated with a deriv position = Units that investor is buying

Portfolio value = V

Vu, Vd= (hedge ratio)(up side of binomial) - (Up’s contract value) = (hedge ratio)(down side of binomial) - (Down’s contract value)

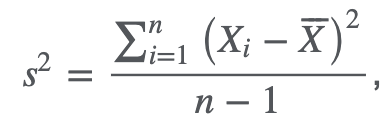

3. Statistical Measures of Asset Returns

Parameter: Descriptive measure of a population characteristic

Measures of Central Tendency:

Measures of Dispersion:

Measures of Shape Distribution:

Measures of Location: Quantile

Percentile: 10th percentile = 0~10% upper bound

Interquartile range (IQR) = Q3-Q1

Yth percentile (Py) using linear interpolation. Ex. 2nd quartile: y = 50%

Box and whisker plot’s middle point = median

Measure of relationship:

Correlation: measures linear relationship between two random variables, -1~1, 0 no relationship

Covariance: measures joint variability between two random variables

If cov positive, cor positive

| Measure of Loc | Population | Sample |

Central tendency | Observed | Parameter | Sample |

Mean | μ | X̄ |

Dispersion | Variance | σ2 , uses n |

|

Standard deviation | σ, uses n

|

|

Relationship | Correlation Corr(X,Y) | ρ = σXY / σXσY | r = sXY / sXsY |

Covariance Cov(X,Y) | σXY = ρσXσY | sXY = ρsXsY |

4. Probability Trees and Conditional Expectations

5. Portfolios Mathematics (Different weights)

Expected return of portfolio: E(RP) = w1E(R1)+w2E(R2)+…+wnE(Rn)

Variance: σ2(RP) = E [{RP-E(RP)}2] = i=1nj=1nwiwj Cov(Ri,Rj)

Total n variances

Ex. σ2(Rp) = w12σ12(R1) + w22σ2(R2) + 2w1w2 Cov(R1,R2)

Ex. σ2(Rp) = w12σ12(R1) + w22σ2(R2) + w32σ2(R3) + 2w1w2 Cov(R1,R2) + 2w1w3 Cov(R1,R3) + 2w2w2 Cov(R2,R3)

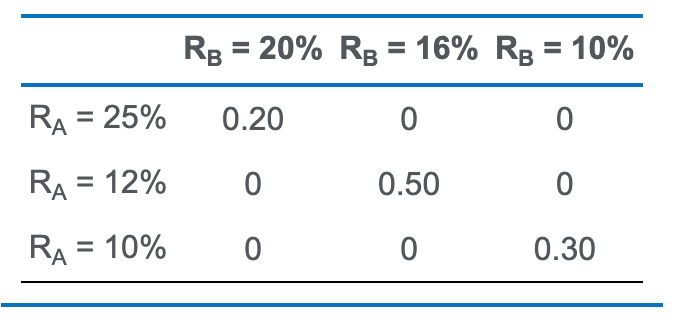

Covariance: Population Cov(Ri,Rj) = E [(Ri-ERi)(Rj-ERj)]

Total n(n − 1)/2 covariances

Shows how co-movements of returns affect aggregate portfolio variance, directions

-∞ ~ ∞

Cov(Ri,Rj) = ρ(Ri,Rj) [σ(Ri)σ(Rj)]

** Covariance with itself: used to find std dev by rooting

Correlation: ρ(Ri,Rj) = Cov(Ri,Rj)/[σ(Ri)σ(Rj)]

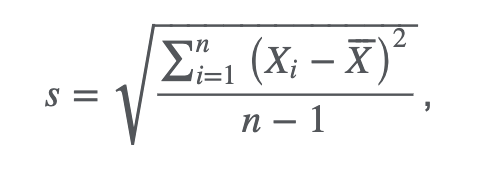

Joint probability function P(X,Y): Cov(RA,RB) = ij P(RA,i,RB,j) (RAi-ERA) (RBj-ERB)

In other words, find probability for both cases, subtract that from the percentages, multiply together, multiply w probability

Probability of joint occurrences of values of X and Y

ER = Expected return = Σ (Probability × RA)

R = Return

Ex.

Independence: if P(X,Y) = P(X)P(Y)

* Stronger than uncorrelated

Uncorrelated: if E(XY) = E(X)E(Y)

Modern Portfolio Theory: Mean-variance analysis,

Safety-first ratio = [E(RP) - RL] / σP

higher SF 🙂

= Distance from TH / sd = units of deviation

Measures downside risk, RL = Threshold, assumes normal distribution

Stress testing, scenario analysis: set of techniques for estimating losses in extremely unfavorable combinations of events or scenarios

Value at risk (VaR): money measure of the min value of losses expected over a time period at a given level of probability

6. Simulation Methods

Lognormal Distribution

Continuously compounded return = Ln (End / Beg)

Skewed right, lower bound of 0

Parameter: mean, std of its normal distribution

Current stock’s continuously compounded return is normally distributed → future stock is lognormally distributed

Assumes: Independently and identically distributed (i.i.d.): Random variables that are independent of each other but follow the identical probability distribution

If not normally distributed, sum is normal due to central limit theorem

More suitable as probability model for asset price, not suitable for asset return (both pos & neg)

Monte Carlo simulation: Inverse transformation method to convert ‘randomly generated uniformly distributed number → ‘simulated value of random variable of desired distribution.’ However, it is an estimate that can not specify cause-and-effect relationship. For predicting modeling, quantifying risk

Resampling: Resampling from single sample for the statistical parameters / estimates like std error, confidence intervals, robustness

Bootstrap method: replace the observed

Jackknife method: no replace, sample size = n = repetition time

7. Estimation and Inference

Probability sampling (random):

Simple random sampling, systematic sampling (kth),

Stratified sampling: divide into strata / subpopulations / index, then simple random sampling from each strata

Cluster sampling: divide into clusters, clusters chosen by simple random sampling

Non-probability sampling: convenience sampling, judgemental sampling

Central limit theorem: larger sample around 30 allows

8. Hypothesis Testing, 9. Parametric and Non-Parametric Tests of Independence

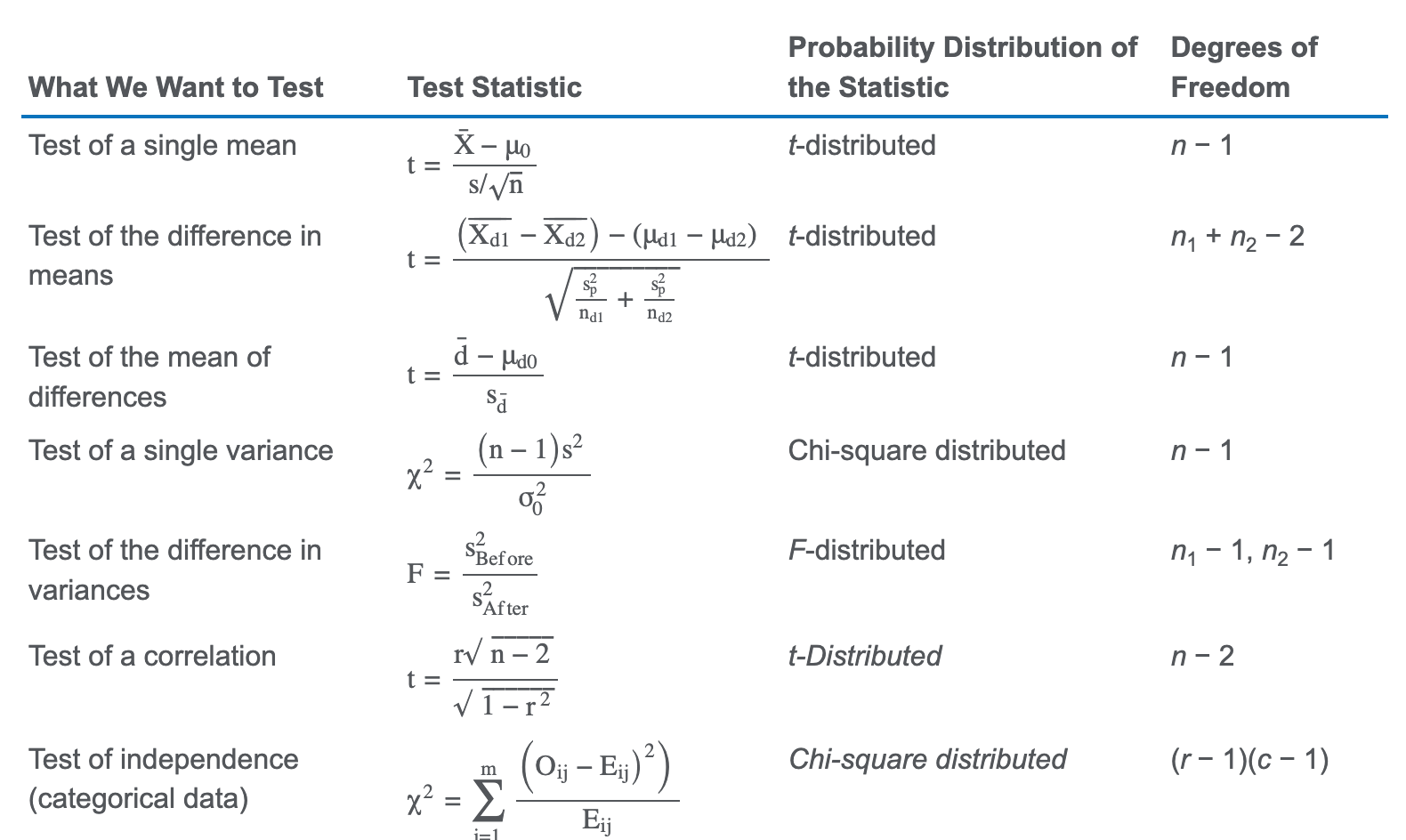

Testing subject | Test statistic | DoF | Info |

| Z = (X-μ) / (σ-√n) |

| Known population variance, large / normal sample, σ 68, 2σ 95, 3σ 99% 90% confidence intervals: z0.05 = 1.65 2σ 95% confidence intervals: z0.025 = 1.96 3σ 99% confidence intervals: z0.005 = 2.58

n stocks, n means, n variances, (n(n-1)) / 2 correlations |

Single mean | t = X̄- μ0s/n | n-1 | Unknown sample or pop variance, large sample Not normal (2 random variables of sample mean, std dev), becomes normal as sample ↑ |

Dif btw means |

| n1 + n2 - 2 | 2 independent samples, 1 sided test H0: μ1- μ2 = 0, so rightside of top = 0 sp2 = (n1-1)s12+ (n2-1)s22n1 + n2 - 2 = pooled estimate of variance IF unequal and unknown pop variance. sp is replaced with s1 and s2 |

Mean of dif | t = đ- μd0sd / √n Paired comparison test | n-1 đ | 2 dependent samples approx normal dist, unknown but assumed equal variance sđ = sd / √n sd = standard deviation difference đ = mean difference = 1ni=1ndi H0: μd0 = 0, so rightside of top = 0 |

Single variance or std dev | 𝛘2 = (n-1)- s2σ02 | n-1 | 1 sided test (asymm), normal distribution σ02 = trigger level ↑n = pdf shape becomes bell curve |

Dif variance | F = s2Befores2After | n1 - 1, n2 - 1 |

|

Pearson / Bivariate Correlation | t = r n-21-r2 | n-2 | R = sample correlation |

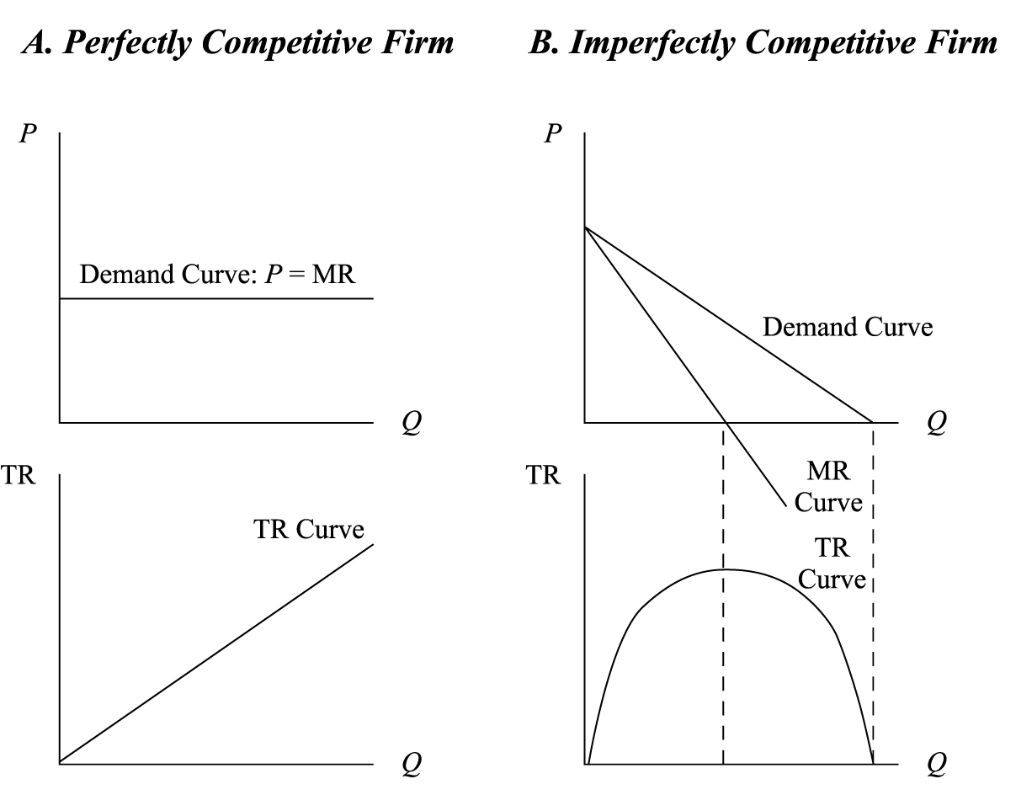

Independence |

| (r-1)(c-1) | Categorical, discrete data using contingency / two-way table, 1 side rejection region H0: size and type are not related / are independent M: num of cells in table O: observed frequency E: expected number of observation assuming independence |

Result \ Reality | True H0 | False H0 |

Fail to reject H0 (Accept H0) | :) 1-α = Confidence level | False negative, Type 2 error = β |

Reject H0 | False positive = False Discovery Rate (FDR, worse), Type 1 error α = significance level | :) 1-β = Power of test |

Non-parametrics: For (1) data does not meet distributional assumptions, (2) there are outliers, (3) data is given in ranks / uses ordinal scale, (4) relevant hypotheses does not concern a parameter. Types include:

Single mean (z, t) → Wilcoxon signed-rank test

Dif btw means (t) → Mann-Whitney U test

Mean differences (t) → Wilcoxon signed-rank test, Sign test

Spearman rank correlation coefficient: rs

Rank observation large (1) to small (n), [if tied, av of joint ranks 3.5]

Calculate dif di between ranks for each pair for X, Y, and find di2

rs = 1 - 6 6i=1ndi2n(n2-1)

10. Simple Linear Regression (SLR)

SLR: method to estimate relation in/dependent variable. Requires minimizing of Sum of Squares Error (SSE, residual sum of squares)

Yi = b0 + b1Xi + εi, i = 1, . . . , n.

Variables:

Y: dependent variable, explained variable, [Calc: Needs to be inputted in second]

X: independent variable, explanatory variable

b0: intercept, regression coefficient, [Calc: as a]

b1: slope coefficient, regression coefficient [Calc: as b]

εi: error / residual = Yi - Ŷ. Least squares RL should have εi = 0

r: correlation = cov (Y,X) / SY SX

Cov(Y,X) = i=1n(Yi - Ȳ)(Xi-X̄)n-1 (X here is X̄), top: Sum of cross-products of deviations from the mean

SY = i=1n(Yi - Ȳ)2n-1

SX = i=1n(Xi - X̄)2n-1 (X here is X̄)

Sum of Squares Total (SST): Variation of Y

= i=1n(Yi - Ȳ)2 = SSE + SSR

Sum of Squares Regression (SSR): explained variation in Y

= ∑(Ŷi - Ȳ)2

= expected - mean

Sum of Squares Error (SSE): Unexplained variation / error / residual in Y

= i=1n(Yi - Ŷi)2 = i=1n[Yi - (b̂0 + b̂1 Xi)]2 = i=1nei2

= observed - expected

Assumption:

Linearity: Relationship between X & Y is linear

Homoskedasticity: Variance of regression residuals are same for all observations

Independence: Observed pairs of X and Y are independent, and regression residuals are uncorrelated across observations

Normality: normally distributed regression residual (not variable)

Measures of Goodness fit:

= SSR / SST

** If slope is positive, correlation (X,Y) = √R2

= se / √i=1n(Xi-X̄̄)2

=

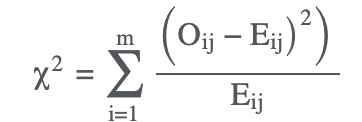

Prediction interval: Ŷf ± tcritical for 𝛂/2 sf

Log-lin model: LnYi = b0 + biXi

Lin-log model: Yi = b0 + b1lnXi

Log-log model: LnYi = b0 + b1lnXi

11. Introduction to Big Data Techniques

Fintech: technology-driven innovation occurring in the financial service industry

Big Data: collection of large quantities of financial data from a variety of sources in multiple formats

Expert system (computer if-then) → neural networks (brain) → machine learning (train / validate / test. Can seem like “black box” or opaque = not fully understandable outcome. Has downsides of overfitting [too cognizant], underfitting. Techniques include supervised learning [only data] / unsupervised learning [labeled] / deep learning [neural networks to find patterns])

Data science: interdisciplinary field harnessing advances in computer science (ML), statistics to extract info from big data. Processing methods include:

Capture: Data collection / formatting for analysis. Needs low latency systems for real time calculation

Curation: Ensure data quality thru cleaning.

Storage: Data record / archive / access

Search: Querying requested data

Transfer: Move storage location to analytical tool

Data visualization: tag cloud (text size = importance), text analytics (large unstructured text like company filings- for ST trends), Natural Language Processing (interpreting human language / translation)

Economics

1. Firm and Market Structures

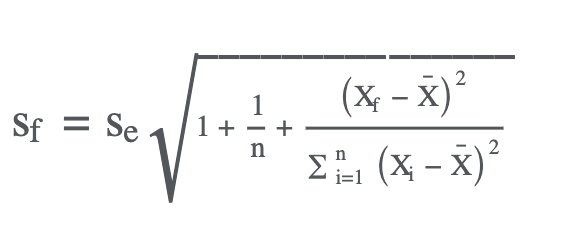

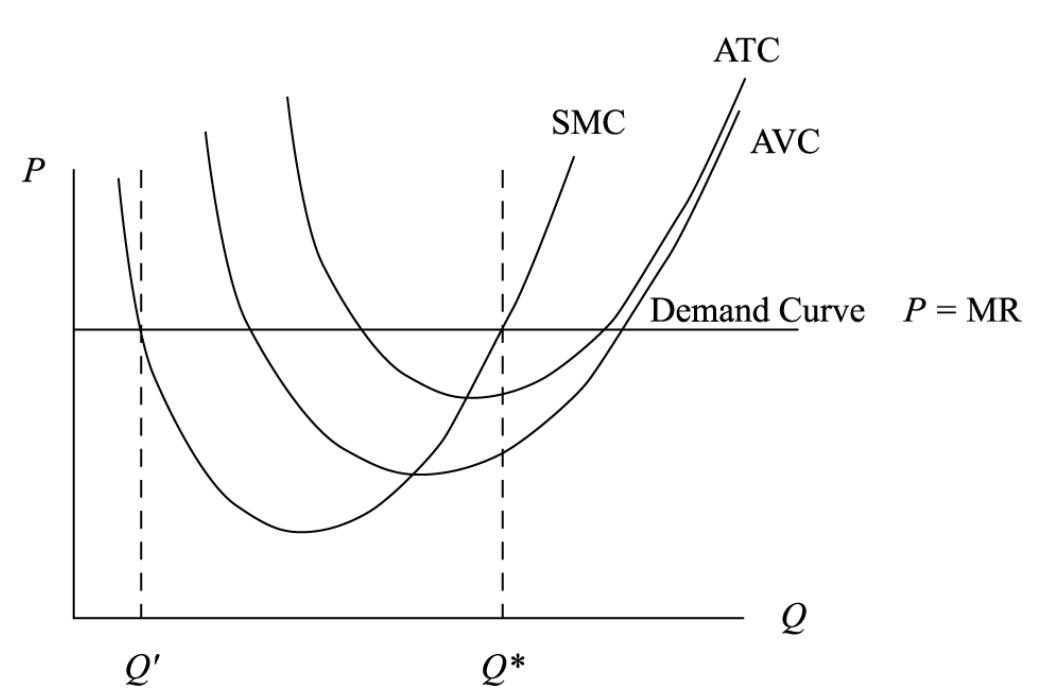

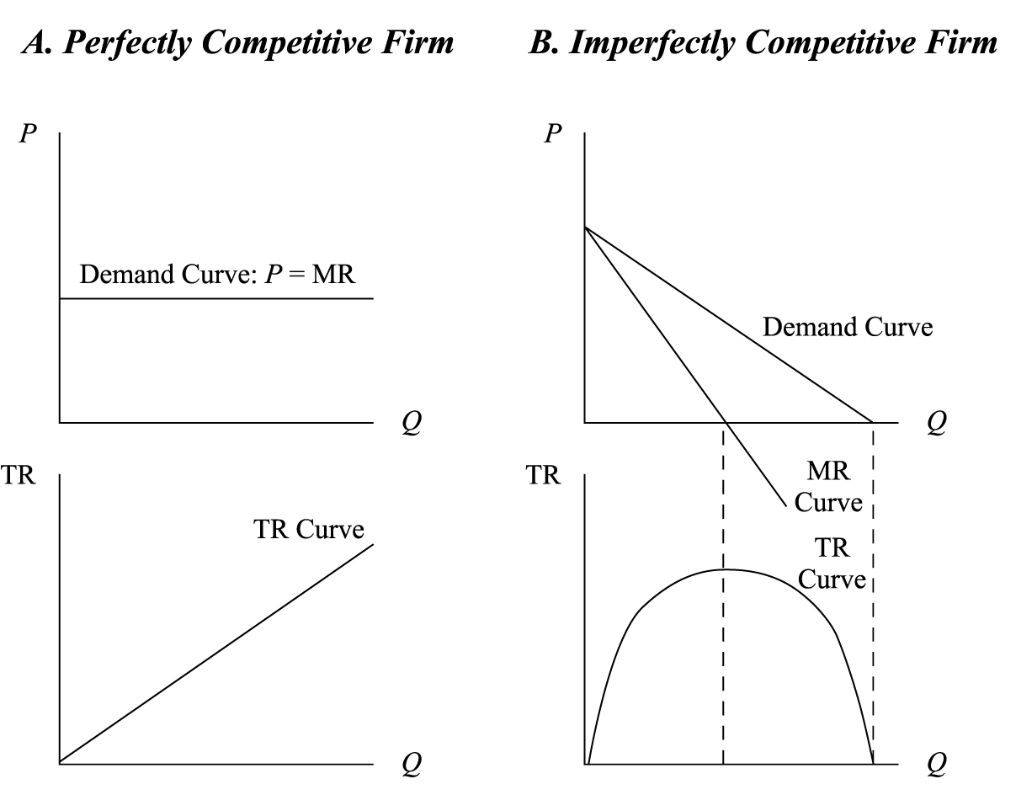

Perfectly competitive

Perfectly elastic (horizontal) demand curve: P = MR

Supply = MC

Average Rev (AR) = price per unit

TR = (P)(Q)

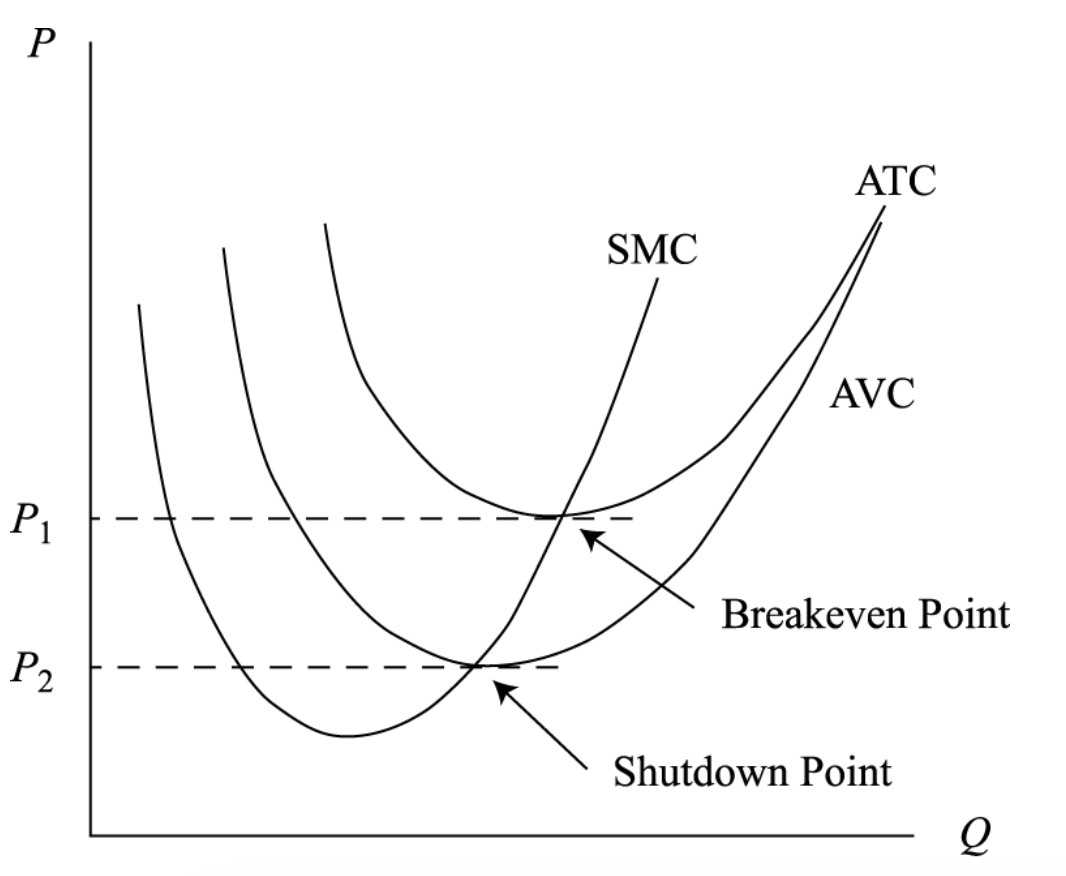

Break even: P (= MR) = AR [TR = TC or AR = ATC]

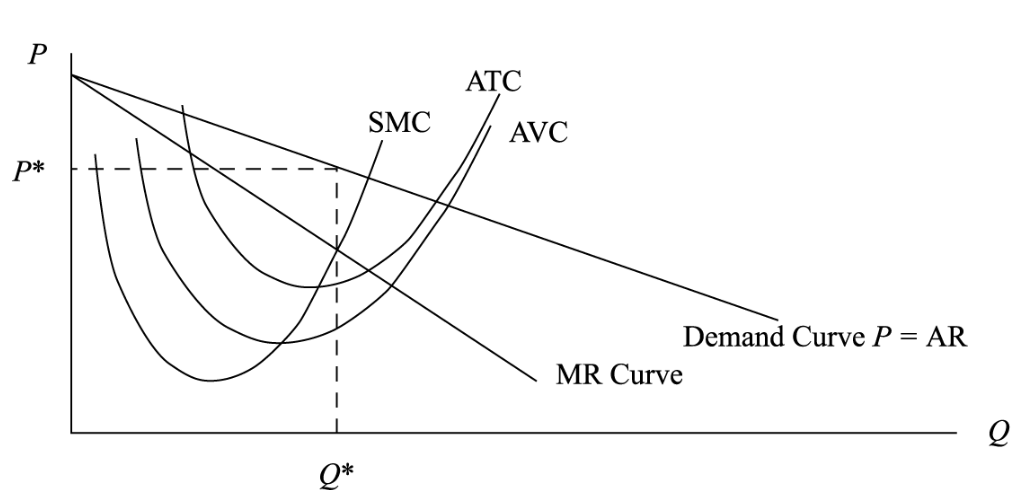

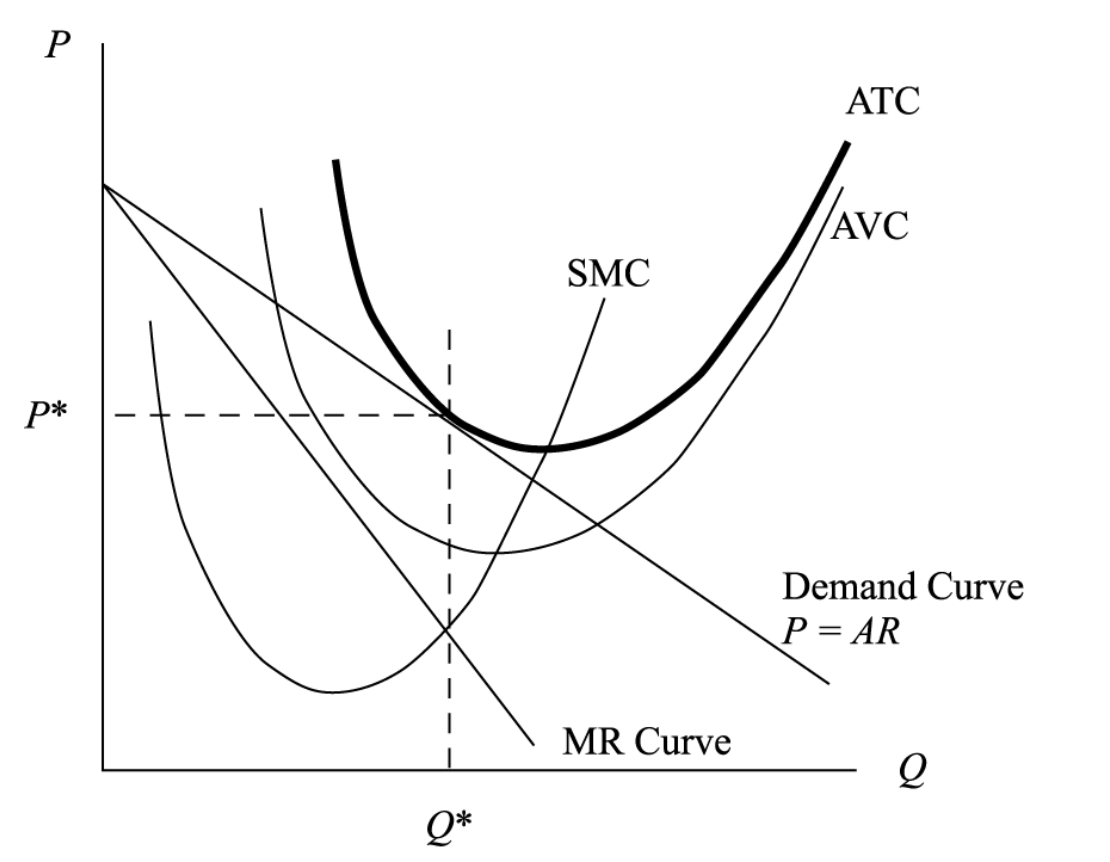

Monopolistic Competition

Characteristic: competitive, unique product, lower barrier to entry, advertising helps profit

Profit Maximization: MR = MC

Negatively sloped demand curve: P = f(Q), P > MR, P = AR

No supply function

TR = f(Q) × Q

Break even: P (= AR) = ATC [TR = TC or AR = ATC] [3rd pic]

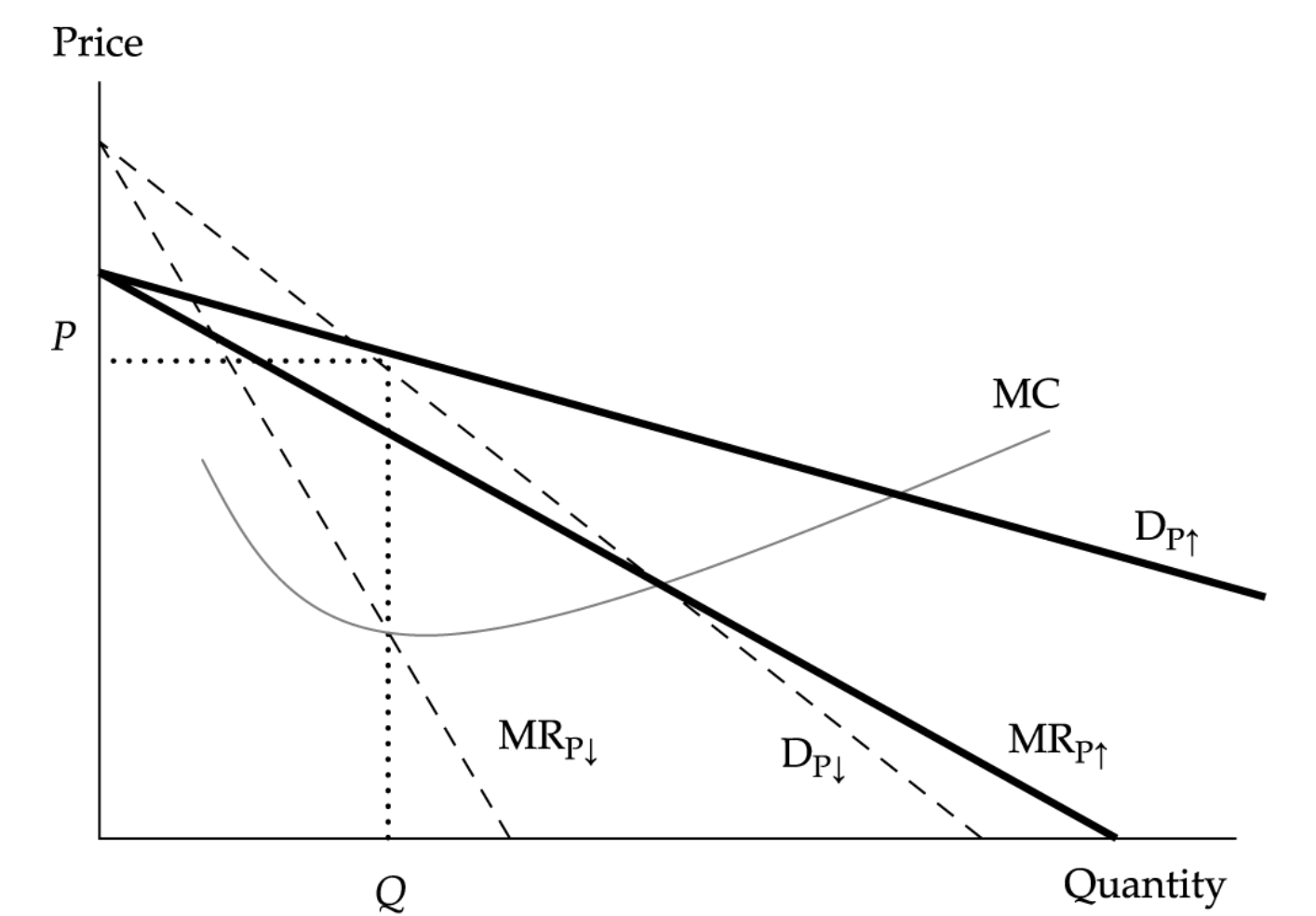

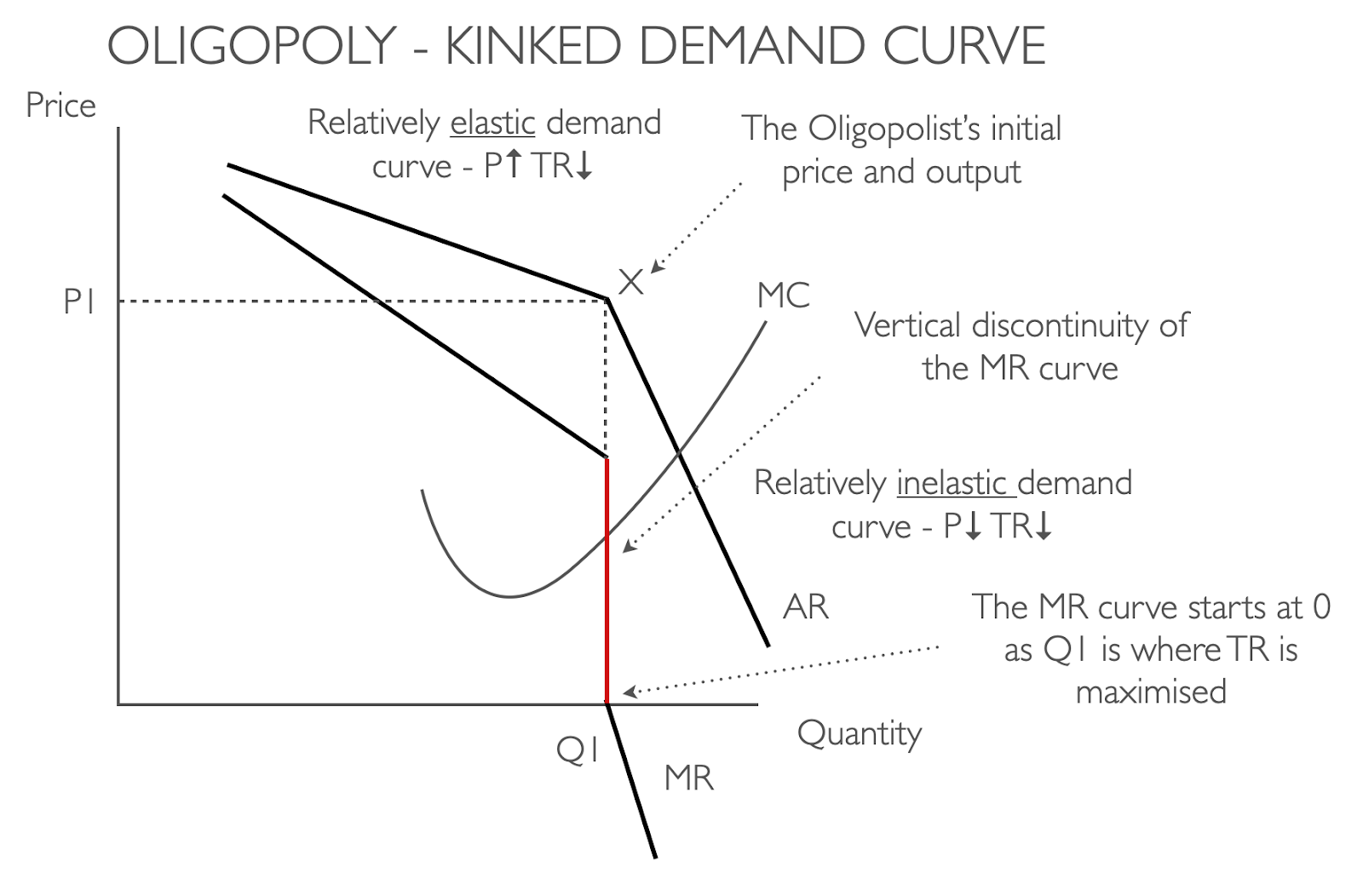

Oligopoly:

Characteristic: Few sellers, standard product, advertising a lot. Attracts collusion

Profit Maximization: MR = MC

No supply function

Pricing strategy:

Pricing interdependence:

Competitors will lower prices to match a price reduction, but will not match a price increase

Can’t determine prevailing price, explains stable prices (red)

Cournot assumption: Firm determines profit maximizing production lvl assuming other firm does not change output. In LT equilibrium, output / price are stable, no increase profits either

Nash equilibrium: Collusion / cartel allows higher prices. collusion more likely if (1) small number of firms / one dominant firm, (2) homogenous product (3) similar cost structure (4) frequent and small order size (5) less likeliness for retaliation (6) high external competition

Stackelberg model: A prominent model of strategic decision making in which firms are assumed to make their decisions sequentially.

If dominant decreases price, smaller comp will leave market rather than sell below cost, thus market share of price leader (dominant comp) will increase. In LT, market share of dominant comp decreases as profits are shared by more participants

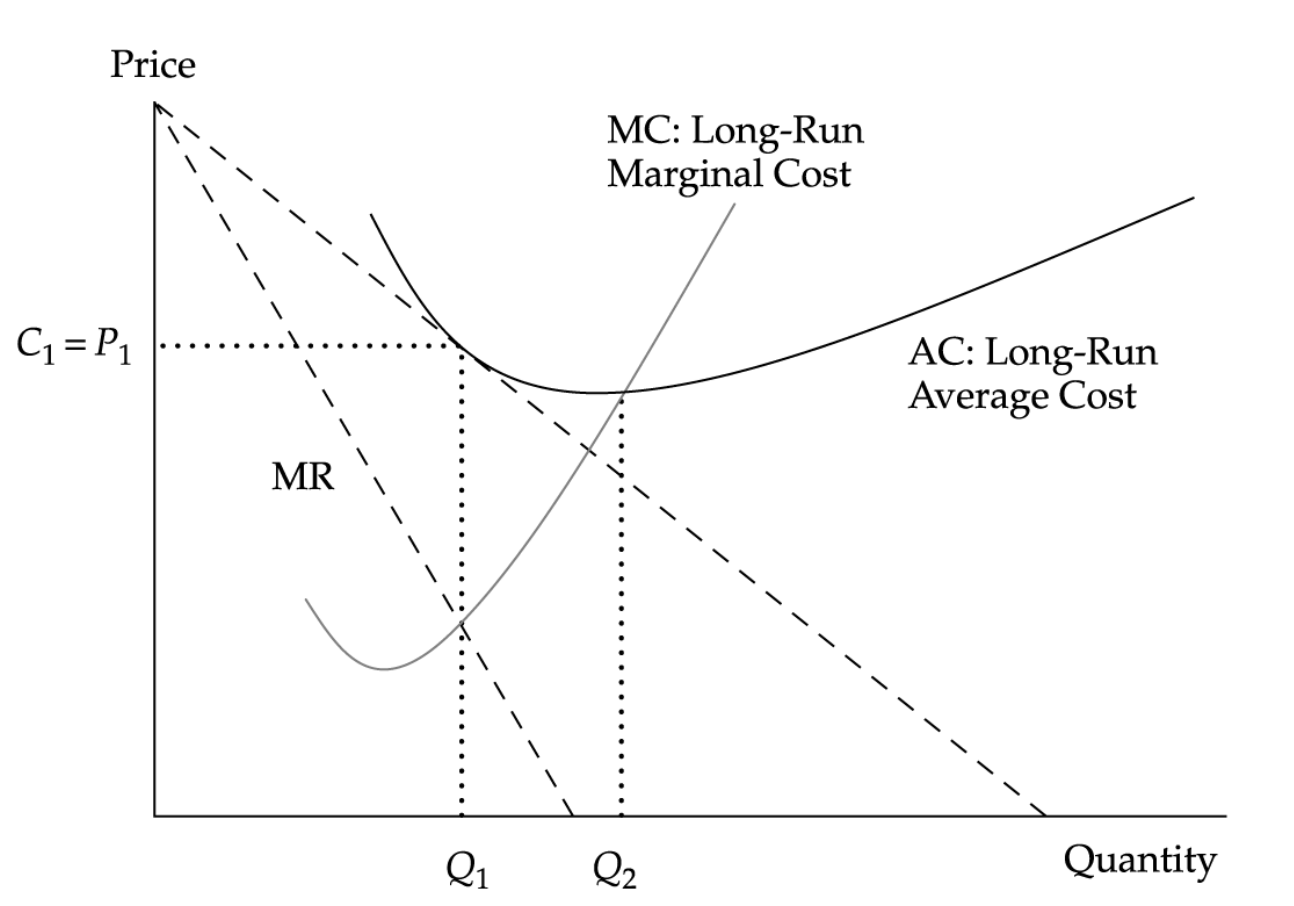

Monopoly:

Characteristic: One seller, unique product, advertising does not help profit

Profit Maximization: Max (TR-TC = π)

Others:

Constant returns to scale: same cost per unit (↑ X input = ↑ X Output)

Economics of scale: ↓ cost per unit

Market power: concentration ratio (0~100, ≠ market power, unaffected by merger), HHI (Σ Comp market share2, Use full number, not the percentage)

2. Understanding Business Cycles

Business cycles: recurrent expansions & contractions in economic activity (mostly GDP) affecting economy

Types:

Classical cycle: Level of economic activity measured by GDP volume terms. Contraction phase (between peaks / troughs) short, expansions large

Growth cycle: Economic activity by LT potential / trend growth level to see how actual economic activity does vs potential

Growth rate cycle: Growth rate of economic activity (GDP growth rate). Peaks and troughs recognized earlier

Phases:

Recovery (trough):

Below av: output worst (vs potential), economic activity (consumer / biz spending, start to increase), low int rate,

Above av: unemp rate

Decrease: negative output gap, layoff, decline in sale, inventory - sales ratio (sales increase faster than production)

Situation: moderate inflation, biz overtime (vs hire), capital spending (excess capacity / low utilization, CAPEX focus on efficiency / light product like software, systems, hardware - high rate of obsolescence)

When expansion is expected: Risky assets repriced upward, corps incorporate higher profit expectations into corp bond / stock prices

Expansion (boom):

Above av: growth rate, activity measures (but decelerating), sales production

Increase: Recovery, consumer spending, company, price / int rate, positive output gap, inflation, capacity utilization

Situation: Employment: overtime / temp → hiring, unemp stabilize / falls, capital spending (new orders focus on heavy / complex equipment, warehouse. factory), stable inventory-sales ratio, Shortage in factors of production, overinvestment in productive capacity may lead to reduce further investment spending

Late stage: biz experience a decrease in qualified workers, productive capacity limits ability to respond to demand

Slowdown (peak):

Above av: activity measures (decelerating), inflation (accelerate), output (vs potential output), consumer optimism, interest rate

Below av: rate of growth

Increase: inventory-sales ratio (weakening economy, sale slows)

Decrease: Growth rate (vs potential output growth), positive output gap, inflation, price level, hiring pace, factors of production (D>S), unemp rate (slower rate)

Situation: stable hiring (slower, rely on overtime), healthy CF, order cancellation

Contraction:

Below av: economic output (vs potential economic output), activity measures, growth

Increase: negative output gap

Decrease: demand, profit, CF, capital spending (CF, short lead time tech / equipment → heavy construction cut off), consumer / biz confidence, comp cost (overtime and hires), absolute economic activity (recession / depression), inflation (lag), employment (cut hours / eliminate overtime / freeze hire / layoff, unemp rate rise), inventory-sales ratio (falls to normal)

Situation: biz produce at rates below sales volumes necessary to dispose unwanted inventory

Economic Indicators

Leading: stock market (S&P), house price, retail sales, interest spread (10 Y treasury yield & overnight borrowing rate - federal fund. Bigger 🙂), building permits for new private housing units, consumer expectation, av weekly hours (manufacturing), manufacturer’s new orders for non-defense capital goods (excluding aircraft), av weekly initial claims to unemp insurance, ISM (Institute of Supply Management, indexes for manufacturing orders, output, emp. Bigger 🙂), LCI (Leading Credit Index, leading financial indicators showing strength of financial system)

Coincident indicators: industrial production index (industrial production reflects current state better than services), real personal income (on non-agri payroll), manufacturing / trade sales

Lagging: Av duration of unemp, inventory to sales ratio (good to maintain 10-20%, Smaller 🙂), change in unit labor cost, inflation (index includes stable service components), ratio of consumer installment debt to income (consumers borrow more when confident), commercial and industrial loans outstanding

Diffusion index: % of index’s components moving consistently w overall index. Reflects consensus change

Nowcasting: real-time monitoring of economic and financial variables to continuously assess current conditions and provide an estimate of the current state.

Credit cycle: Fluctuation of credit measured through liquidity of priv sector (loans, investment, real estate). Strong economy = loose credit (may contribute to asset price and real estate bubbles and subsequent crises)\

3-4. Policies

Policies: Stable / positive growth, stable / low inflation

Fiscal Policy: Influence on Taxation, Spending to control growth / GDP. Affects overall Aggregate Demand (AD) and activity, distribution of wealth / income, resource allocation

AD: amount companies and households plan to spend. Fiscal policy influences AD

Keynesians: Fiscal 🙂 on AD, output, esp if substantial spare capacity (considerate unemp) in economy

Monetarists: only temp effect on AD, monetary policy more effective to restrain / boost inflation

*Debt

Ok: debt may be owned by citizens or used for capital investment, private sector may offset fiscal deficits by increasing savings foreseeing increased taxes (Ricardian equivalence - reason to choose Monetary policy, future impact of fiscal are fully discounted by economic agents)

Not ok: high debt → high tax disincentivizing economy by reducing labor effort / entrepreneurship, lose confidence in gov → print money to finance deficit / high inflation, gov borrowing diverts private sector investment (crowding out - gov borrowing ↑ → private sector investment ↓, ↑ int)

Tools:

Transfer payments: Ex. comprise payments for state pensions, housing benefits, tax credits - not included within GDP / gov spending on G&S

Current gov spending: Regular spending on G&S. Impacts country’s skill lvl, labor productivity

Capital expenditure: Infra - adding to nations’ capital stock / affect potential for economy

Cyclically adjusted budget deficits are appropriate indicators of fiscal policy in full employment

Government revenue: Direct tax (national insurance, property / inheritance tax. Slow, powerful results), indirect tax (G&S, excise duties on fuel, alcohol, gambling, VAT. Quick results)

* Excise: tax on certain objects

* Tax is desirable due to simplicity, efficiency (limit interference), fairness (similar situation - horizontal equity, rich pay more - vertical equity), Rev sufficiency

Model:

Symbols:

G: Government spending

T: Taxes including in/direct taxes on expenditures

B: Transfer benefits

NT: Net Taxes

Y: National income or output

YD: Disposable Income

t: Net tax rate, proportional to Y

Multiplier: △ equilibrium output / △autonomous spending that caused the change

Fiscal multiplier: △ gov spending / △ national income

c: Marginal Propensity to Consume (MPC) = Consumption / YD

s: Marginal Propensity to Save (MPS) = Saved / YD

NT = T - B

Budget surplus / deficit: G-T+B = Net impact of gov sector on AD

YD = Y – NT = (1 – t) Y

Household spending = cYD = C(Y-NT) = c(1-t)Y

Fiscal multiplier = 1/[1 – c(1 – t)]

c + s = MPS + MPC = 1

** If ↑ gov spending on domestic goods financed by equivalent ↑ tax, ↑ AD bc MPS < 1 thus every dollar less in disposable income, spending falls by $c. ↓ Aggregate spending amount < ↑ tax rise by factor of c. Additional output leads to ↑ income, output thru multiplier effect

** Contractionary always involves fall in budget deficit / rise in surplus. Sometimes gov spending can accompany bigger fall in taxation, making it expansionary

Types: Automatic stabilizer (income tax, VAT, social benefit - fiscal stimulus reducing multiplier size, don’t require policy changes), discretionary fiscal adjustments (tax changes, spending cuts)

Difficulties:

Lags: Recognition, action, impact lag

Focuses more on inflation than on unemployment

Private sector unknown / changes over time

* Cyclically adjusted budget deficits (full employment) are appropriate indicators of fiscal policy

Monetary Policy: Influence Q of Money, Credit for price stability (Faster than Fiscal)

Bank role: Banker to gov and bankers’ bank, lender of last resort, regulator and supervisor of the payments system, conductor of monetary policy, supervisor of the banking system

Tools:

Open market operations (Quantitative Easing): Purchase (↑ reserves, expansionary) /sale of gov bonds from/to commercial banks/designated market makers

Official interest / policy / refinancing / repo / discount / fed funds rate: influence S/LT int rate, and real economic activity. ↑ Int → ↑ Base rate (ref rate banks base lending on). Interest rate works through ST int rate, changes in key asset prices, exchange rate, expectation of economic agents, in order to influence inflation

Contractionary: When gov believes ↑inflation, ↑int rate, ↓liquidity [↔ Expansionary]

Neutral rate of interest = Real trend of growth + LR expected inflation

If demand shock (people feeling good for spending), tightening monetary policy is suitable

If supply shock (oil cost), tightening may be worse for situation

Reserve requirements: requirement for banks to hold reserves in proportion to the size of deposits

Inflation targeting framework: Credibility, transparency (reporting), independence - includes

Operational independence: Bank’s independence to execute monetary policy, set int rate to meet inflation target

Target independence: Bank’s independence to define inflation target, rate of inflation, horizon of target

Exchange rate targeting: can “import” inflation experience of econ whose currency is being targeted

Setting: Domestic country A sets currency exchange rate target to align with USD

Change: A develops rapidly, A domestic inflation above US, A currency fall against USD

Protect A: gov sells foreign currency reserve, buys own currency = reduce domestic money supply, increase ST interest

Monetary tightening: exchange rate rise against dollar

Shortfalls:

Bond market vigilantes: Bond market participants may reduce D for LT bonds, pushing up yield

Liquidity trap: Money demand completely elastic (horizontal), thus money injection does not help lower int or affect real activity

Monetary & Fiscal Policy [Assumption: Wage, P are rigid]

Fiscal (Gov rev) / Monetary (MS)

Easy F / tight M:

↑ Int rate (↓ priv sect), ↓ tax, ↑ gov spending, ↑Aggregate Output / ↓ MS

Tight F / easy M:

↓ Int rate (↑ priv sect), ↓ public sector

Easy F / easy M:

↓ Int rate (↑ priv sect), ↑ AD (↑ public sect)

Tight F / tight M:

↑ Int rate (↓ priv sect), ↓ AD (↓ public sect), ↑ tax / ↓ gov spending

Tight F: ↓ public sector, gov less spending // Tight M: ↑ int, ↓ priv sector

5. Introduction to Geopolitics

Geopolitics: Study of how geography affects politics and international relations. Actors (Indiv, org, comp, national gov carrying out political, economic, financial activities) influence and include state actor (national gov, political org, country leaders exerting direct authority over national security / resource) / non-sate actor (on-governmental organizations (NGOs), multinational companies, charities)

Globalization: Trade of G&S, Capital flow, currency exchange, cultural / informational exchange

↔ Nationalism

In order to lessen the extreme impact, nations (1) Reshore essentials [pandemic - relocating back to own country, use domestic / existing capacity more intensely], (2) Reglobalizing production [fortify / duplicate supply chains abroad], (3) Doubling down on key markets [strengthen focus on risky]

International organizations

IMF: stabilize exchange rate, assist reconstruction of the international payment system. More specifically, it enhances lending facilities, improves monitoring of global / regional / country economies, helps resolve global economic imbalances, analyzes capital market developments, assesses financial sector vulnerabilities

World Bank: help developing countries fight poverty and enhance environmentally sound economic growth

WTO (World Trade Organization): provide legal and institutional foundation of the multinational trading system

Archetypes of Globalization & Cooperation

| Globalization | Nationalism / Anti-globalization |

Cooperation | Multilateralism: mutually beneficial trade, extensive rule harmonization Multilateral trade agreements (WTO) Economy and Monetary Union (EMU) Common market (EU) Cabotage: right to transport passengers / goods

| Bilateralism / regional: leveraged regional trade, bias against globalization |

Non-cooperation | Hegemony: Countries using political / economic influence on other to control resources Nationalization of key export firms / industries (Pemex. PDVSA, Rosneft) Foreign investment restrictions Economic and financial sanctions (US, EU vs Venezuela) Export subsidies (Boeing, Airbus)

| Autarky: Political self-sufficiency w no trade, state owned enterprises control strategic domestic industries |

Geopolitical risks: Event (date driven), exogenous / black swan (sudden - uprising), thematic risk (overtime - climate, migration, cyber threat). Must check event likelihood, impact velocity (speed), and impact size / nature. Signpost is a indicator risk is going up / down. Highly collaborative, interconnected countries are vulnerable to geopolitical risk, high geopolitical risk results in tangible macroeconomic effects

6. International Trade

Traditional models: Ricardian model and the Heckscher–Ohlin model: focus on specialization and trade according to comparative advantage arising from differences in technology and factor endowments, respectively

Trade protection / restrictions: Limit the openness of goods markets. ↓ consumer surplus, ↑ producer surplus

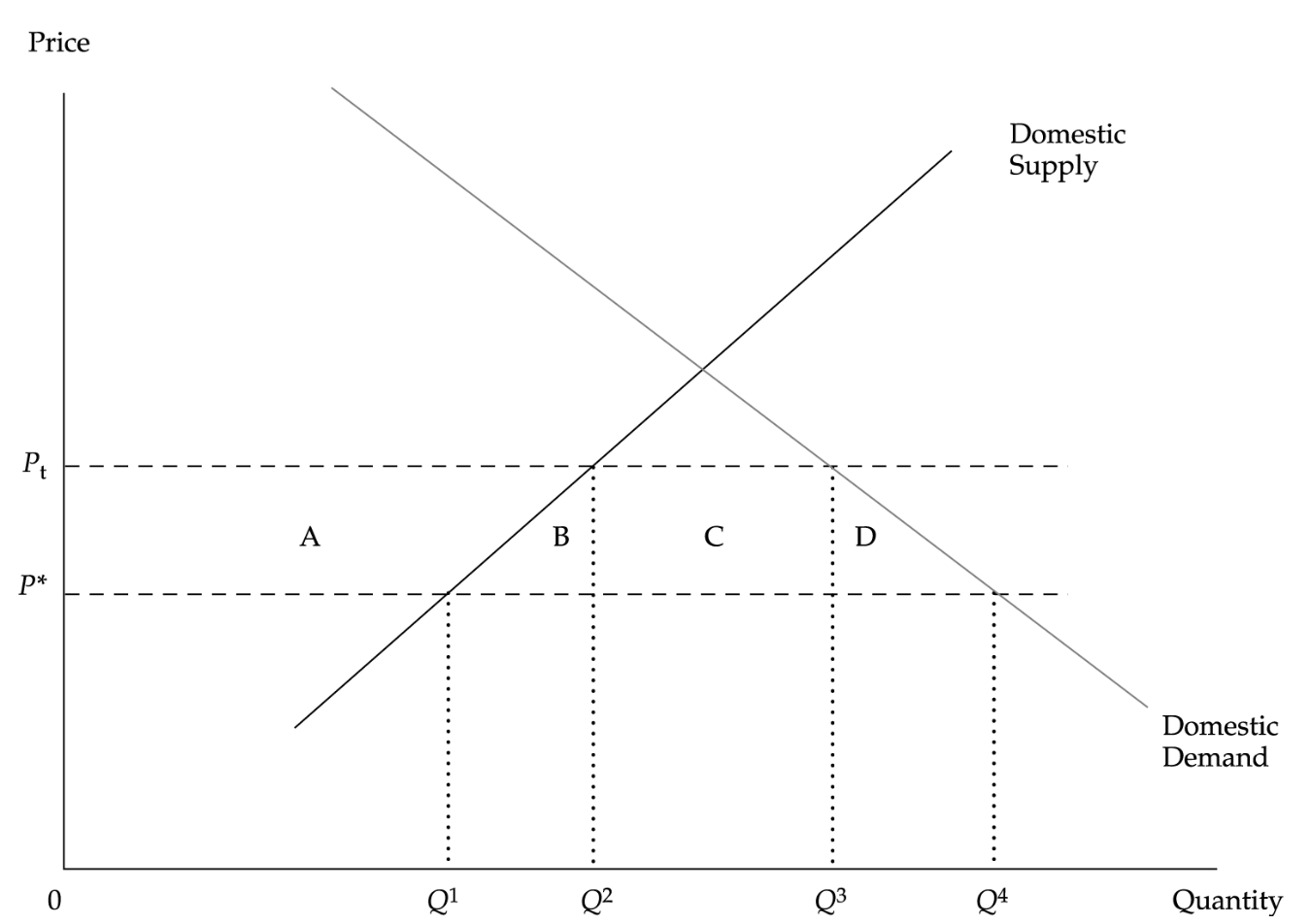

Tariff: Protects domestic goods, ↓ trade deficit, tariff revenue collected by gov, Small country (price taker)

Price P* → Pt, Import Q1~Q4 → Q2~Q3

Consumer loss: - (A+B+C+D)

Producer surplus: +A

Tariff Rev / quota rent / gov gain: +C

National welfare deadweight loss: -(B+D)

** May increase if large country

Quota: Restriction of Q imported w Q set thru import license

Quota rent / profit captured by domestic OR foreign gov: C

National welfare loss: -(B+D+C)

National welfare of foreign country captures quota rent by auctioning import license: -(B+D)

** May increase if large country

Voluntary Export Restraints (VER): Quota / trade restriction by exporting country → ↓ imported goods → ↑ import good price → VER affects / benefits foreign country → greatest welfare loss for importing country bc domestic pays more for same product

Capital restrictions: controls placed on (1) foreigners’ ability to own domestic assets (2) domestic residents’ ability to own foreign assets. Limits the openness of financial markets

Trading bloc / Regional Trading Agreement (RTA):

Free Trade Area (FTA): Free movement of G&S

Customs Union: FTA + common trade policy for non-members

Common Market: Customs Union + free movement of factors of production

Economic Union: Common Market + common economic institution, policies

Monetary Union: Economic Union + common currency

Others:

7. Capital Flows and the FX Market, 8. Exchange Rate Calculation

Exchange rate:

Nominal / Spot exchange rate: Sd/f

= Price / Base = cost of 1 unit of base currency in terms of price currency

= A/B = number of units of currency A that 1 unit of currency B will buy

= USD/EUR exchange rate of 1.17 = 1 euro will buy 1.1700 US dollars = 1 euro costs 1.1700 US dollars, direct quote for European citizens

Nominal adjusted for inflation, assess changes in the relative purchasing power of one currency compared with another

Uses Direct quote d/f

Purchasing power parity (PPP): LT equilibrium of nominal exchange rates

A wants to purchase from foreign country B. A buys fewer goods if nominal spot exchange rate for foreign currency appreciated / foreign price level increased. ↑ real exchange rate = ↓ foreign goods purchasable, ↓ A’s relative purchasing power compared to B

S (Nominal) does not affect Purchasing power

Sd/f × Pf = Foreign price level in domestic currency

Ex) British wants to buy EUR goods [GBP as Price, not base]

Real exchange rateGBP/EUR = SGBP/EUR * (CPIEUR/CPIGBP)

Nominal spot exchange rate GBP/EUR ↑10%, EUR price level ↑%5, UK price level ↑%2

Change in real exchange rate = (1+10%) * [(1+5%)/(1+2%)] -1 = 13%

Real exchange rate ↑13%, costs more to buy EUR goods

== ↑ real exchange rate, ↓relative purchasing power

If Real exchange rate =↑ 5%, Real purchasing power ↓5%

Market participants

Sell side: large FX trading banks (Citigroup):

Buy side: Those using sell side undertake FX transactions. Includes: Corporate accounts (cross-border purchase / sales of G&S, investment), Real money account (unleveraged funds managed by insurance / mutual fund / pension / endowment / ETF), Leveraged account (leveraged professionals managed by hedge funds / proprietary trading shop / commodity trading advisors CTA / high frequency algorithmic trader / proprietary trading desks at banks), Retail, Gov (military purchase), Central banks (influencing domestic exchange rate), Sovereign wealth funds (SWF, gov entities for investmentpurpose rather than public policy)

Market products: FX swaps (Spot + forward FX transaction), Spots (immediate delivery), Forwards (customizable future delivery vs futures), Option

Quotation

Bid: price bank buys currency

= number of units of the price currency client receives from dealer for 1 unit of base currency

Offer: price bank sells currency

= number of units of the price currency client sells to dealer for 1 unit of base currency

Ex. CHF/EUR = 1.1583 - 1.1585:

Client receives CHF 1.1583 (Bid) for selling EUR1

Client pays CHF 1.1585 (Offer) to dealer to buy EUR 1

Dep of A 10% relative to B, (1/1-0.10)-1 % relative to A

% Appreciated exchange rate = % Appreciation of base currency * initial exchange rate

Appreciation of A against B = expected spot / spot -1

Currency regimes:

Ideals: (1) Credibly fixed exchange rate - no currency related uncertainty, (2) Fully convertible currencies - unrestricted capital flow, (3) Fully independent monetary policy.

Regimes: Independently floating rates, Fixed parity with crawling band,

No legal tender: (1) Dollarization, (2) Monetary union (EUR)

Currency Board System (CBS): domestic only issued w foreign currency reserves against the domestic monetary base. Bank is not lender of last resort. Best if (1) wages flexible, (2) non-traded sectors are small (2) global supply of reserve asset grows at a slow, steady rate consistent with LR growth, stable prices. Can earn seigniorage - profit by paying little / no in on its liability (monetary base) to earn market rate on its asset (foreign currency reserves). Ex. HKD

Fixed parity: Currency pegged at currency / basket with (1) no legislative commitment to maintaining parity, (2) target level of foreign exchange level optional

Target zone: Fixed parity w larger band: more freedom / discretion in monetary policy

Active / passive crawling peg: Pegs against single currency, updated periodically

Fixed parity + Crawling bands

Managed / dirty float: Rate based on target policy

Independently floating rates: Rate based on market

Trade balance:

X − M = (S − I) + (T − G),

X = Exports,M = Imports

S = Private Savings, I: Investment

T: Taxes net of transfer, G: Gov expenditure

Investors anticipate change in exchange rate → Sell currency expected to depreciate, buy currency expected to appreciate. Asset prices, exchange rates adjust so potential flow of financial capital is mitigated, actual capital flow remains consistent w trade flow. Thus, capital flow (potential + actual) determine exchange rate movements in ST to intermediate term

In order to stop capital flight (foreign investment in liquid domestic asset suddenly decrease), restrict foreign investment in liquid domestic asset & encourage foreign direct investment.

Forward rate calculation: (indirect format)

In Derivative : 4. Arbitrage, Replication, Cost of Carry in Pricing Derivatives

8. Exchange Rate Calculation

Forward rate calculation: (indirect format)

*** Sf/d × (1 + Forward points as a percentage) = Ff/d

** Ff/d / Sf/d = 1+ rfτ1+rdτ : Forward Premium for base currency (F > S) if int rate in price currency > base currency (rf > rd)

Portfolio Management I

1 ~ 2. Portfolio Risk and Returns

Two Risky Assets Calculation for Return & Variance

Portfolio Return

Rp = i=1nwiRi, i=1nwi = 1

If 2 assets,

E(Rp) = w1R1 + (1-w1)E(R2)

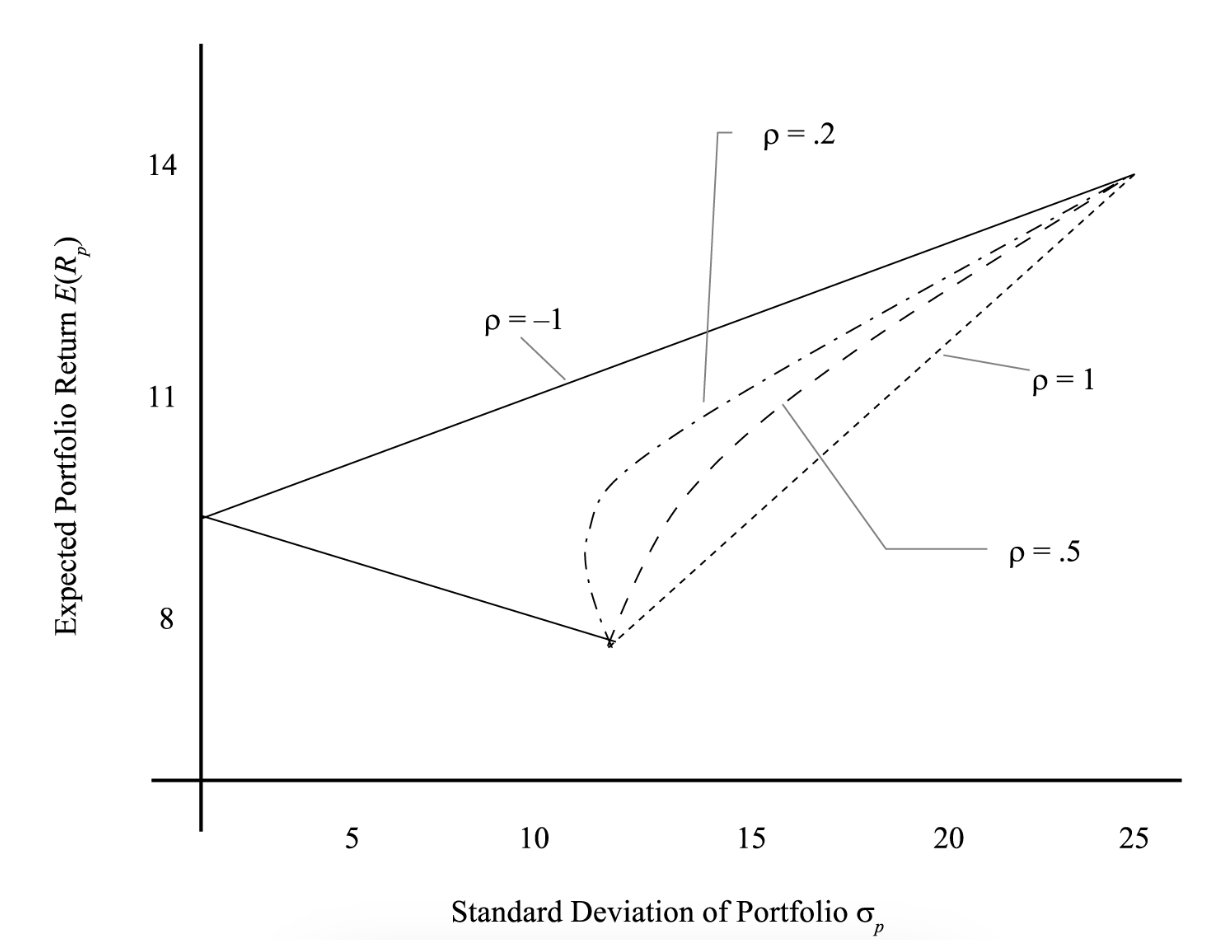

Portfolio variance

ρ -1~1

If ρ = 1, no reduction in risk

If ρ <1, little bit of diversification perks

If ρ = -1, portfolio can be made RF

Multiple assets:

σP2 = σ bar 2N + N-1N Cov bar

Where σ and Cov bar are average

= As ↑ N in equally-weighted portfolio, ↓ contribution of each individual asset’s variance to volatility of portfolio.

If N is large, Cov has largest impact on variance

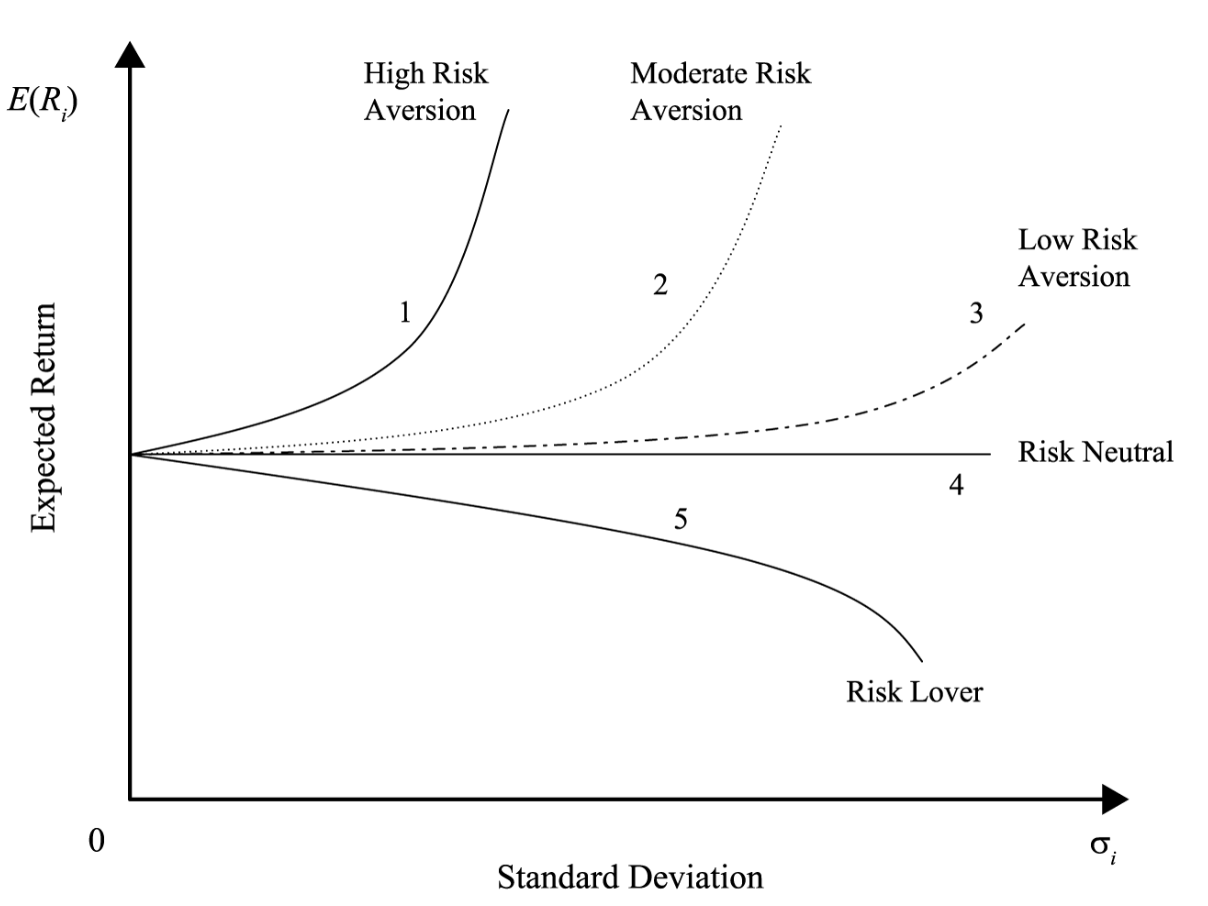

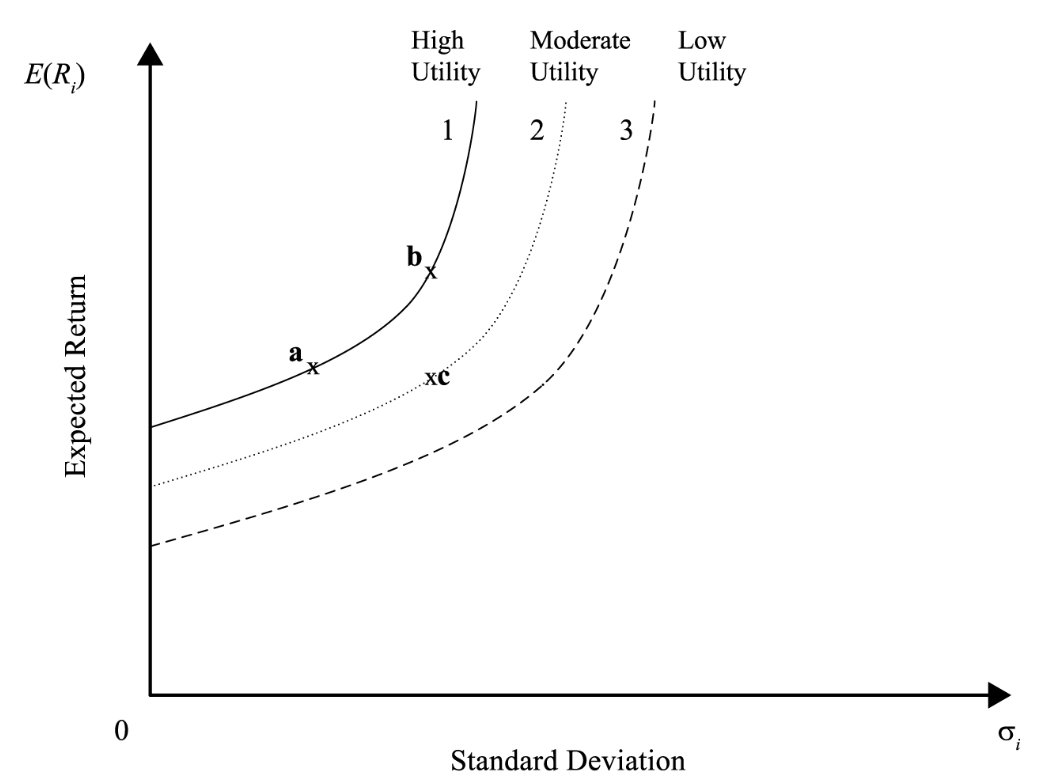

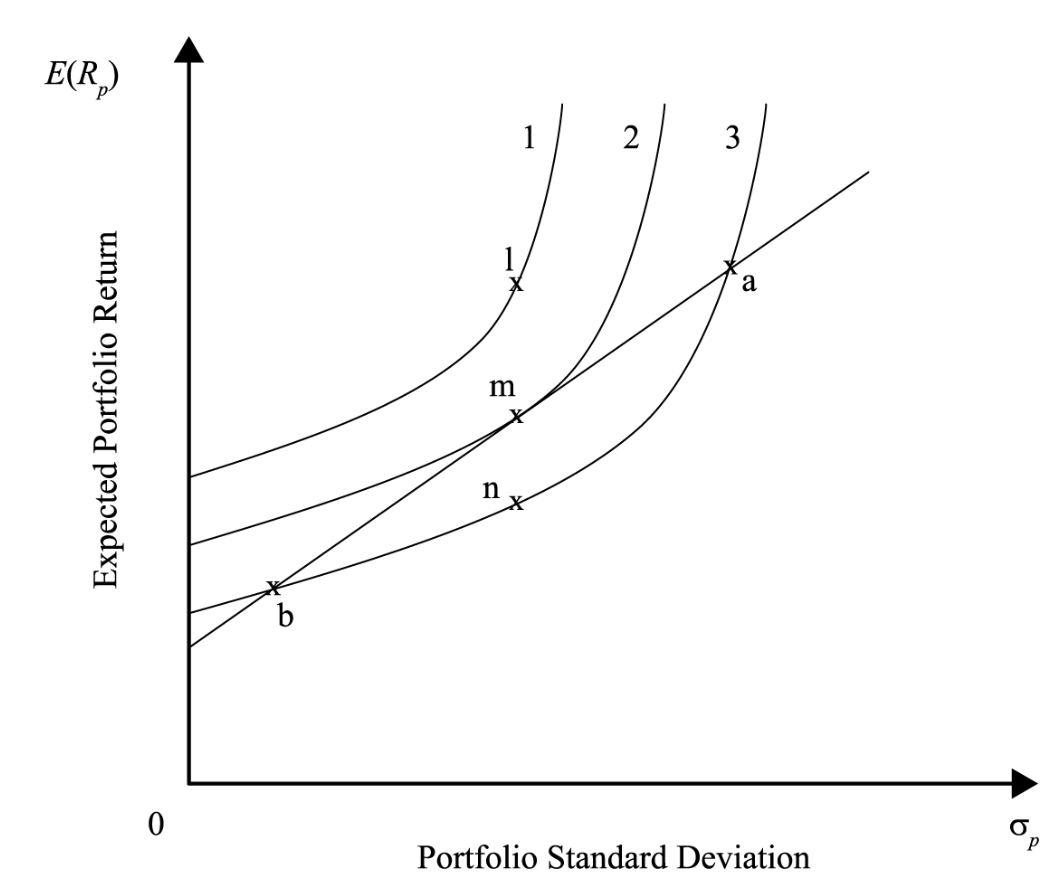

Indifference Curve: combinations of risk–return pairs investor would accept to maintain given level of utility

Utility Theory:

U = E(r) - 12Aσ2

Definition: Measure of relative satisfaction from consumption of various G&S / portfolio

Expected return OR negative term based on the portfolio risk weighted by risk aversion

Conclusions: (1) utility unbounded on both sides (2) higher return = higher utility (3) , higher variance reduces utility, reduction amplified by risk aversion coefficient (4) utility ≠ satisfaction

Loving: exponential, Neutral: linear, Aversive: logarithmic

Different Indifference Curves Different utilities for risk aversive indiv

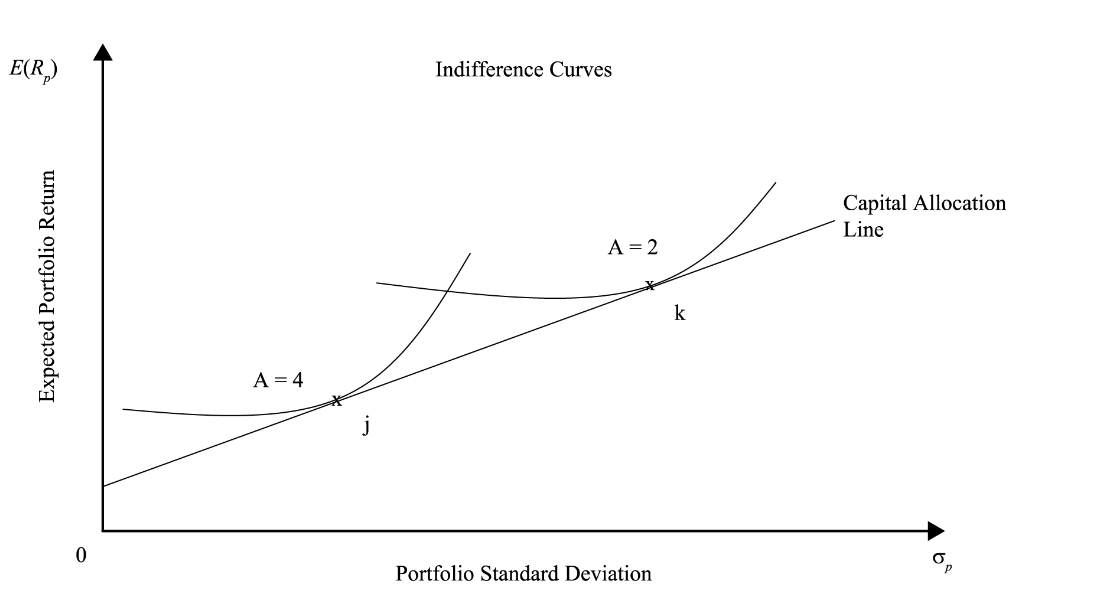

Capital Allocation Line (CAL): portfolio of risky assets + RF assets

E(Rp) = Rf + E(Ri)- Rfσiσp

RF asset has 0 risk, return Rf

Risky asset has σi risk, expected return E(Ri)

E(Rp) = w1Rf + (1-w1)E(Ri)

σp = (1-w1)σi

Different Utilities of 1, 2, 3 for high aversive Different Risk Aversions of A = 2, 4. 2 has higher expected return

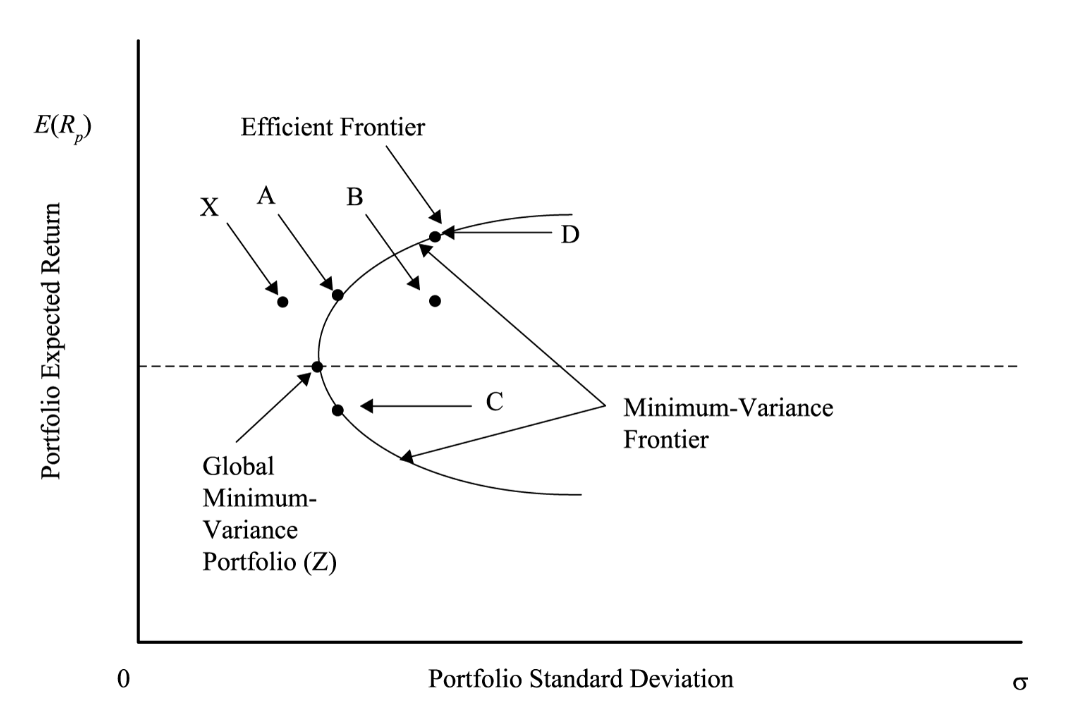

Efficient / Min Variance Frontier of Risky Assets: min var achievable for given level of expected return

Global Minimum Variance Frontier: portfolio of lowest possible portfolio volatility for a number of underlying assets

Markowitz efficient frontier: Portfolio of risky assets w highest expected return for a given level of risk OR lowest amount of risk for a given level of return. Global min variance frontier ~ up / right.

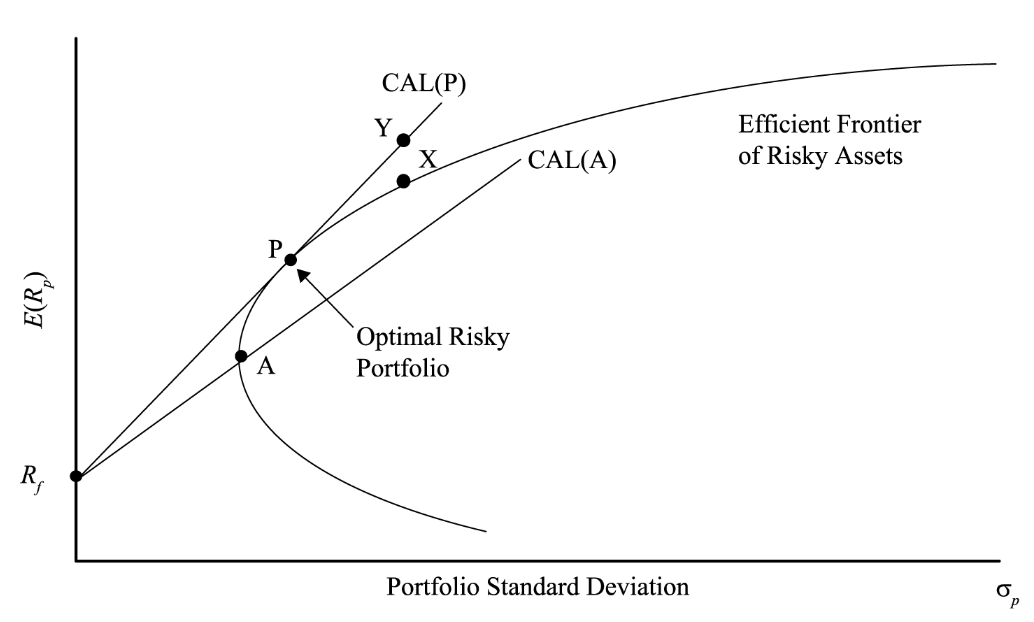

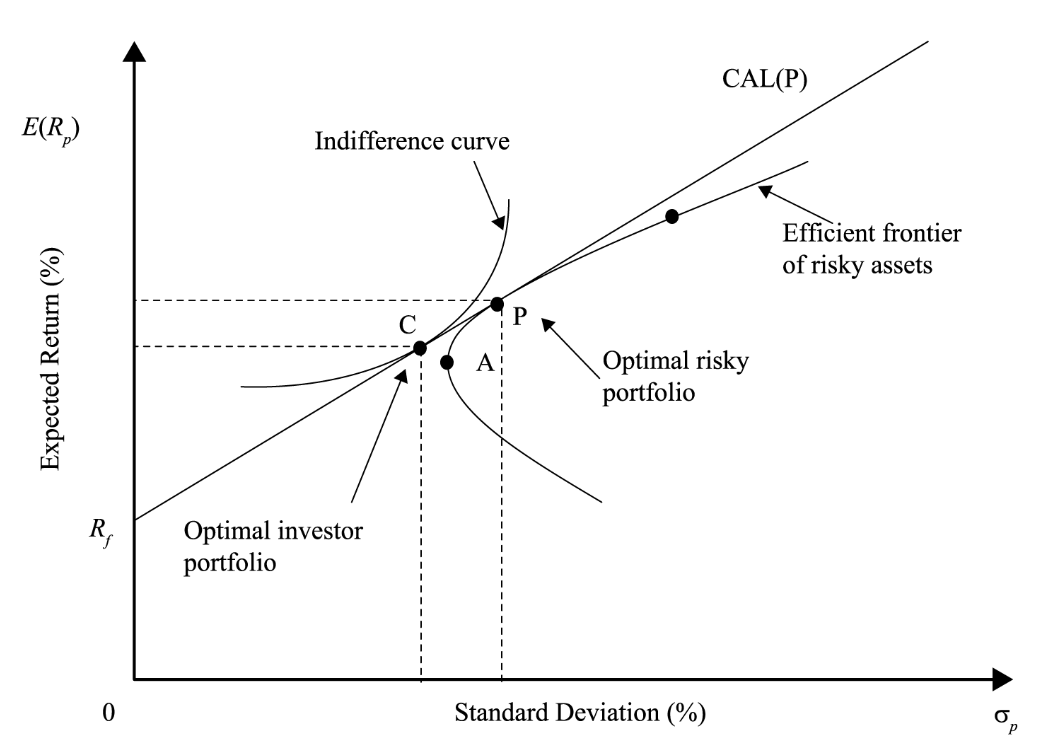

CAL + Efficient Frontier

CAL (P) = dominant CAL combining RF asset + optimal risky asset portfolio

It has higher rates of return for levels of risk because of the investor’s ability to borrow at RF rate

CAL + Efficient Frontier + Indifference Curve

Optimal Risky Portfolio = CAL + Efficient Frontier

Optimal Investor Portfolio = CAL + Indifference Curve

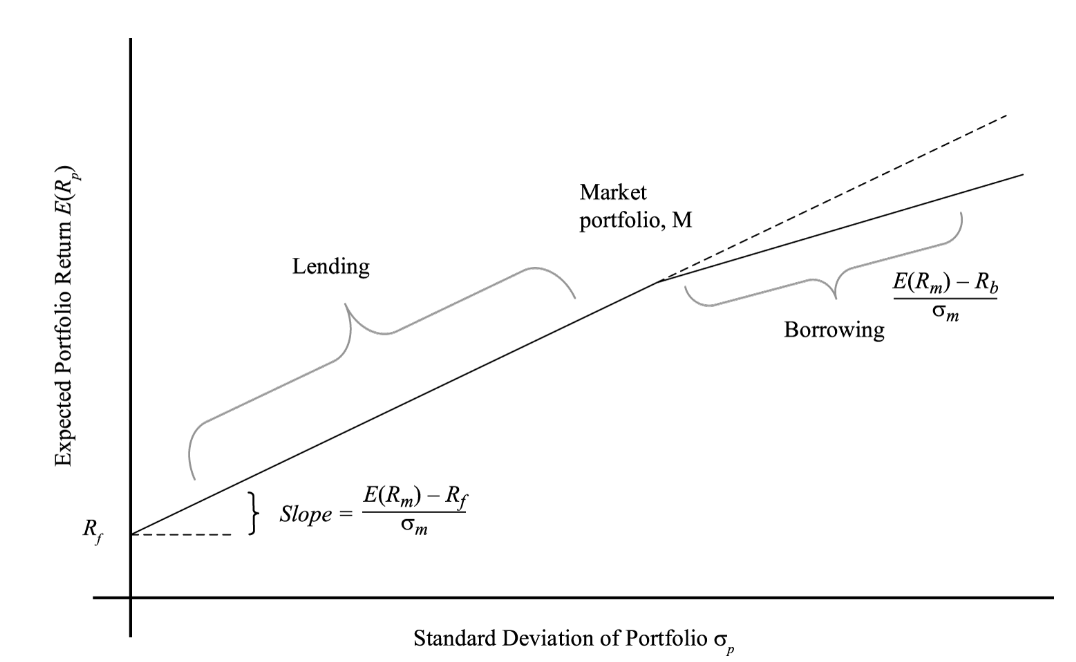

CML: Line w intercept as RF, tangent to efficient frontier of risky assets. RF + market portfolio (risky assets)

CML w dif lending rates:

When w1≥0 (lending), E(Rp) = Rf + E(Rm)- Rfσmσp

When w1<0 (borrowing), E(Rb) = Rf + E(Rm)- Rbσmσp

Return Generating Model: Model providing estimate of expected return of security given certain parameters

For Single-Index Model,

E(Ri) - Rf = βi [E(Rm) - Rf]

For Market Model,

Ri = αi + βiRm + ei

Fundamental factor model: bases on earning growth, CF generation

Total variance = Systematic β variance + Nonsystematic variance

σi2 = βi2 σm2 + σe2

Systematic / non-diversifiable / market risk β: risk affecting entire market / econ. According to Capital Market Theory, Systematic risk is priced

Nonsystematic risk: risk to single comp / industry

Covariance dropped bc any non-market return is uncorrelated with the market

βi: Measure of how sensitive an asset’s return is to the market as a whole, market / systematic risk

= Cov(Ri, Rm)σm2 = ρi,m σiσm

Market weight of portfolio: total $ / owning $

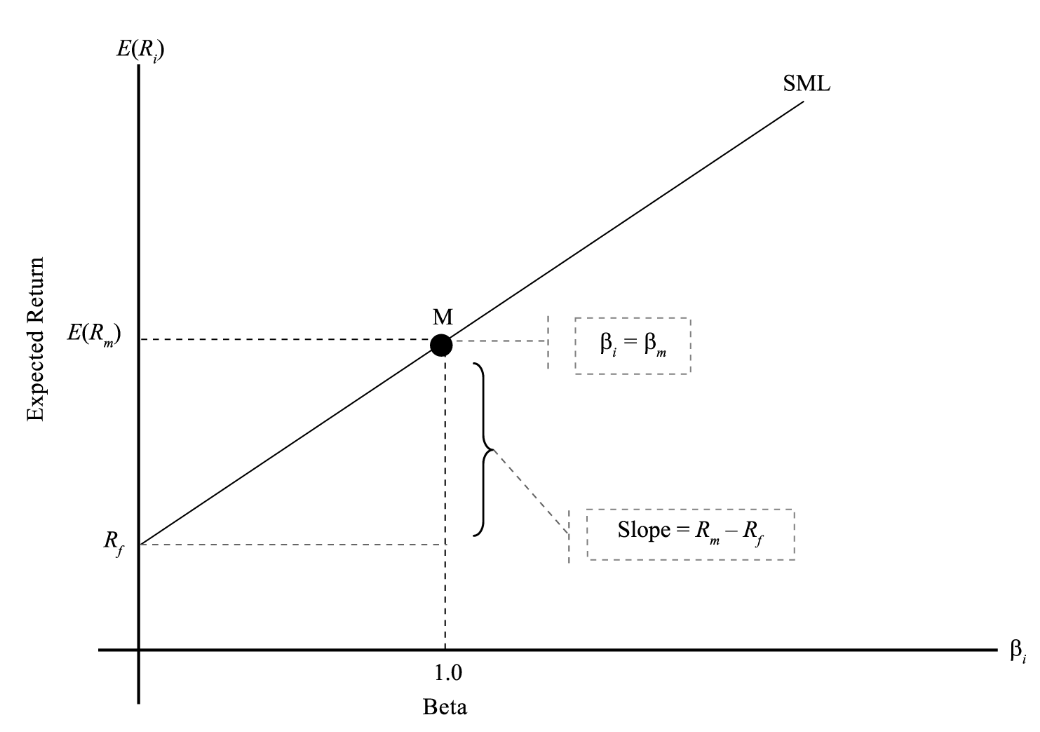

Capital Asset Pricing Model (CAPM): E(Ri) = Rf + βi [E(Rm) - Rf],

Assumptions:

Investors are risk-averse, utility-maximizing, rational individuals

Markets are frictionless- no transaction costs / taxes

Investors plan for the same single holding period

Investors have homogeneous expectations / beliefs - allows for the existence of the market portfolio

All investments are infinitely divisible

Investors are price takers

Security Market Line (SML): CAPM on graph

(Above SML: Undervalued / Under SML: Overvalued)

(Above SML: Undervalued / Under SML: Overvalued)

Slope: R m-Rf or [E(Rm) - Rf]: Market risk premium

Portfolio beta = w1β1 + w2β2

Above SML: Undervalued, Under SML, overvalued.

* CAPM finds the Require Rate of Return, E(Ri), which is the amount justified according to its risk within CAPM model. If the ROR < Expected return, it lies above SML, and position shows that security offers a greater return against its inherent = risk is undervalued

Limitations: Single factor / period model, Market portfolio (noninvestable assets), Proxy for market portfolio, Estimation of Beta risk, Poor predictor of returns for CAPM, Homogenigy of investor expectation

Security Characteristic Line:

Ri - Rf = αi + βi (Rm - Rf)

Excess return of a security on the excess return of the market

From Jenson’s αp = Rp - {Rf + βp [E(Rm) - Rf]}

heterogeneity in beliefs of investor, but they are price takes

Jensen’s alpha is the intercept and the beta is the slope.

Performance Evaluation: Measurement / assessment of outcomes of investment mngmnt decisions

** When portfolios are fully diversified, only systematic risk matter

Sharpe / Reward-to-variability Ratio (SR)

= [E(Rm) - Rf] / σp = Risk premium / risk

Excess return per unit of risk. Similar to CAL slope

Adjusts Total Risk, which is for portfolios not fully diversified

Justified ex ante/ post basis

High Sharpe ratio = best risk adjusted performance

Limitations: (1) Adjusts for Total Risk when only systematic is priced, (2) Comparative only (3) Must be positive numerators- neg → incorrect rankings

Treynor Ratio (TR)

= [E(Rp) - Rf] / βp

Excess return on investment w no diversifiable risk

Uses systematic risk beta, which is for fully diversified portfolio

Justified ex ante/ post basis

Limitations: Comparative only (2) Must be positive numerators- neg → incorrect rankings

M2 : Risk Adjusted Performance (RAP):

= [E(Rp) - Rf] σmσp + Rf = SR * σm + Rf

Adjusts Total Risk risk using Standard Deviation to reflect std dev of market, which is for portfolios not fully diversified

Shows what portfolio wouldve returned if it took on total risk as market index. Compare return premiums of adjusted VS market index portfolio

Jenson’s Alpha αp:

= Rp - {Rf + βp [E(Rm) - Rf]}

(actual portfolio return) - (calculated risk-adjusted return) = Abnormal return over the theoretical expected return. Measure of portfolio’s performance relative to market portfolio

αp > 0: Outperform market

Justified ex ante/ post basis

Uses systematic risk beta, which is for fully diversified portfolio

Portfolio Management II

1. Portfolio Management, 2. Portfolio Planning and Construction, 3. Behavioral Biases of Individuals

Basics:

Diversification ratio: SD of equally weighted portfolio / SD of randomly selected security

Portfolio reduces risk more increasing returns

Investment needs: Bank has highest need for liquidity, Endowment has longest term

When defining asset class, (1) assets within a specific asset class have high paired correlations and low correlations with other asset classes. (2) mutually exclusive, add up to approximation of relevant investable universe

Tactical Asset Allocation: deliberate deviation from IPS

IPS Process:

Planning Step: Understanding the client’s needs, Preparation of an investment policy statement (IPS)

Execution Step: Asset allocation, Security analysis, Portfolio construction

Feedback Step: Portfolio monitoring and rebalancing. Performance measurement and reporting

IPS Specifics: Introduction, Statement of purpose, Statement of duties and responsibilities, Procedures, Investment objectives / constraints / guidelines (“distinctive needs”), Evaluation and review, Appendices (strategic asset allocation, rebalancing policy)

Asset mngmnt:

Buy-side: investment mngmnt comp using services of broker dealer

Sell-side: broker/dealer selling security, research, recommendation

Mutual fund: commingled investment pool where investor in fund have pro-rata claim on income / fund value

Open-end fund: trade at NAV, have capital gain distributions

Close-end fund: have capital gain distributions

No-load fund: no fee for investing / redeeming fund share, annual fee based on % of fund NAV

Load-fund: Annual fee + % fee to invest in fund / redemptions

ETF: do not have capital gain distributions

Risk & Return:

Absolute risk: variance / standard deviation, value at risk (money measure of min value of loss expected during time at X probability)

Subjective risk: tracking risk / error (std dev of dif btw portfolio return / benchmark return)

Behavioral Finance:

Illusion of control (over uncontrollable): restrict model to imp variables

Conservatism: review flexible model regularly

Representativeness bias (classifying w standard, not comp specific): Result in under-diversified portfolios. take both into perspective

* Base rates: attributes of reference class, neglect would ignore it in favor of other opinion

Base rate neglect, sample size neglect

Confirmation bias: Result in under-diversified portfolios. incorporate other opinions, seek guidance

Hindsight bias: “history was predictable”

Anchoring / adjustment bias: relying on prev to judge next

Mental accounting bias: looking at everything singularly rather than synergy

Framing bias: asking framed questions

Availability bias: near me

Risk aversion: sensitive to loss than gain thus show disposition effect (investor reluctant to dispose of losing investment, sell when gain too quickly = inefficiency)

Overconfidence: share all forecasts, scenario analysis. “Don’t confuse brains with a bull marke / bubbles” to reduce self-attribution, halo-effect (good now, may make good decision on something else later), ST over incentivization may lead to bubble

Self-control bias: forget ab LT goals bc ST

Status-quo bias: do nothing

Endowment bias: more value when asset owned

Regret-aversion bias: do nothing bc fear regret

4. Risk Management

** Establish risk tolerance → risk budgeting → risk exposure

Risk mngmnt: Process where org / indiv establishes defines / measures lvl of risk to be taken and adjusts to maximize comp or portfolio’s value / indiv’s overall satisfaction / utility. Comprises all decisions / actions needed to best achieve orgal / personal objectives while bearing tolerable risk level

Framework: Risk governance, Risk identification / measurement (quant / qual assessment), Risk infra (database - Risk identification, measurement, monitoring), Defined policies / processes, Risk monitoring / mitigation / management, Communications, Strategic analysis / integration

Good risk governance: Top-down guidance which directs risk mngmnt activities to support overall enterprise. Governance proceeds enterprise wide (not in isolation), determines org’s risk tolerance / provide max loss org can absorb

Factor to be considered: competitive position

Factors not considered in risk tolerance: personal motiv / belief / agenda of BOD, comp size, market environment stability, ST pressure, mngmnt compensation

Risk budgeting: how and where risk is taken and quantifies / allocates tolerable risk by specific metrics

Risk types:

Financial risk: Risk from comp’s capital structure like lvl of debt. Includes Market, Credit, Liquidity risk

Non-financial risk: Risk from external financial market change like accounting rule / legal environment / tax rate change. Includes settlement risk (default risk when settling payments before default), legal risk (sued, contract not upheld by law), compliance risk (regulatory, accounting,tax risk), model risk (wrong model), tail risk (outlier), operational risk (terrorism, WC), solvency risk (bankruptcy)

Risk measuring:

Market risk: SD (not for non-normal, overestimates risk), beta (market risk), value at risk (VaR, tail size to find min loss expected, sensitive to inputs), CVar (Conditional VaR to find max loss expected, can understate risk) scenario loss, delta (small changes in deriv), gamma (large changes in deriv), vega (deriv’s underlying), rho (int for deriv), duration (sensitivity to int). Means thru scenario analysis, stress testing (loss in scenario analysis)

Credit risk: liquidity / solvency / profitability / leverage, strength / cyclicality of macro / industry. Ex. Credit VaR, prob of default, expected loss given default, prob of credit rate change

What to do with risk:

Risk acceptance: bear risk, self-insurance by setting reserve fund to cover loss, diversification

Risk transfer: insurance = surety bond

Risk shift (change distribution): use deriv (forward & contingent claim)

Corporate Issuers

Business Structures:

Governance:

During legal claim, stakeholder (debtholder) → creditors (int /principal), supplier (account payable), gov (tax), employee (wage) → shareholder (Equityholder)

Equity: loss limited to equity investment

Climate change considerations: (1) physical risk - climate risks that may be insured / diversified (2) Transition risk- transition to lower carbon. Ex. stranded assets (unviable asserts)

Stakeholder conflicts:

Principal - Agent (agency) relationship: principal hiring agent to perform task

Managers interest can diverge (1) insufficient effort (2) inappropriate risk appetite (3) empire building (4) entrenchment - retain job (5) self-dealing - corruption

Debtholders prefer equity raising to limit SH distribution, SH prefers greater leverage. SH distribution than dilutive equity

SH meetings:

Annual General Meeting (AGM): board member elections, independent auditor appointment, FS / dividend director auditor compensation approval, nonbinding vote on compensation plan

Extraordinary GM: special board member election proposed by SH, bylaw / article amendments, M&A / takeover / asset sales, capital increase, voluntary firm liquidation

SH activism protects interest by increasing SH value. May lead to litigation / lawsuit: proxy contest (group persuading SH to vote for group), tender offer, hostile takeovers. Comps can defy with SH Rights Plan / poison pills

Creditors (bondholder / private lenders) protects interest by bond indenture (contracts), creditor / ad hoc committees

Audit committee: Monitors financial reporting process (selection / implementation of accounting policies), supervises internal audit function / independence / competence, recommends independent external auditor and proposing its remuneration

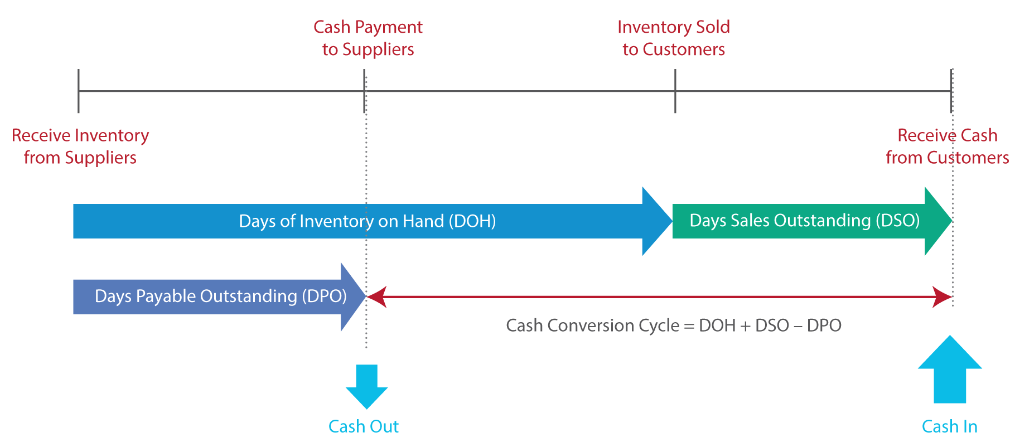

Working Capital Liquidity:

Operating Cycle: Company’s acquisition of goods / raw materials ~ collection of cash from sales.

Cashflow may not happen at same time as activity

Inventory: Cost of products produced or purchased for sale

Recognized when issuer takes ownership of materials, goods, supplies

Derecognized when product is sold to customer

Account Receivable (AR, BS ST asset): $ to be collected for products sold.

Account Payable (AP, BS ST liab): $ owed to suppliers for products received

Recognized when product is received, issuer defers / delay payment to supplier

Derecognized when cash is paid to supplier

**2/10 net 30 : 2% discount if account paid within 10 days, and otherwise full amount due in 30 days

Secondary Liquidity: (1) suspend / reduce div for SH (2) delay / reduce capital expenditure (3) issuing equity (share issuing provides cash but dilutes exiting SH cost) (4) renegotiation contract terms (ST debt, debt covenants) (5) selling asset (6) bankruptcy

Factors affecting Liquidity:

Drag on liquidity (inflow): event reducing available funds / delays cash inflows

Uncollected AR: Measured by av # of days receivables are outstanding, level of customer payment delinquencies as a percentage of receivables

Obsolete (out of date) inventory: If finished goods held too long in inventory, may mean no more demand / products only sold at discount

Borrowing constraints: ST debt more expensive / unavail when credit conditions tighten

Pull on liquidity (outflow): event accelerating cash outflows or trade credit availability is limited, requiring companies to expend funds before they receive proceeds from sales that could offset the liability

Early payments: w out benefits = comp forgoes fund use

Reduced credit limit: when comp pays late often, supplier can cut credit

Limit on ST lines of credit: by bank / gov mandate / market related

Low liquidity positions: liquidity shortage due to industry condition / weak financial position. May be exacerbated w aggressive WC mngmnt (more cash, ST, cheaper)

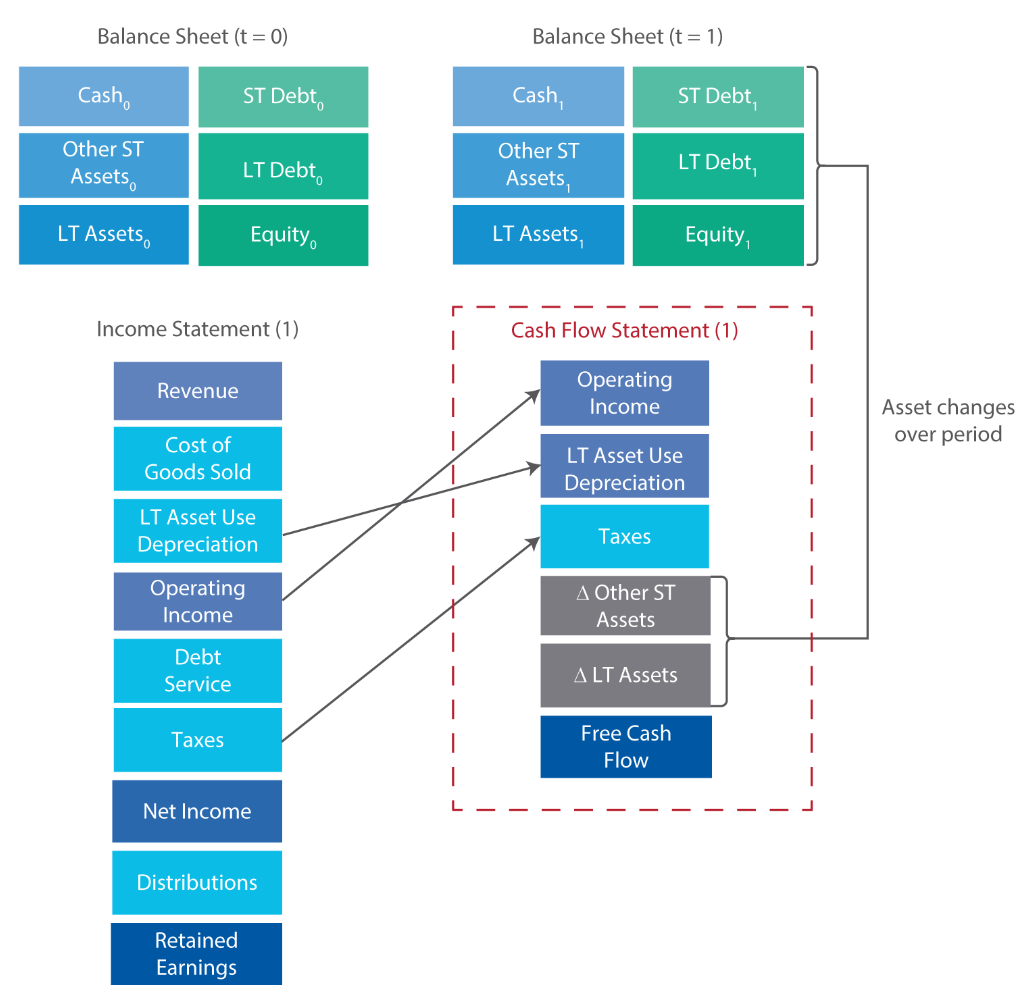

Capital Investments and Capital Allocation

Capital Investment / Projects:

1~ investments, initially recorded at cost (like most assets)

IS: Expenditure not recorded, Non-cash dep / amort over asset life recorded

BS: Expenditure recorded, Subsequent periods presents net basis (cost - accumulated dep / amort) to 0 or salvage value

CF Statement: Cash capital spending reported as incurred

Project types: (1) Going concern / maintenance [operation] (2) regulatory/compliance projects [3rd party required] (3) Expansion (4) Other [high risk new initiative]

Capital Allocation - Investment analysis (time-value-of-money concepts.)

= PV of investment CF inflow - PV of CF outflow

Internal Rate of Return (IRR)

t=0TCFt(1+IRR)t = 0

= Disc rate making NPV = 0

Required Rate of Return = Hurdle Rate: Preferred / min return return on investment that a fund must reach before a GP receives carried interest

Multiple IRRs exist if cash flow signs (+/–) change more than once

Return on Invested Capital (ROIC) or Return on Capital Employed (ROCE)

= After-tax Op ProfittAv Invested Capital = (1-Tax rate) Op profittAv total LT L&E Invested Capitalt-1, t

= After-tax Op profitSales × SalesAv Invested Capital

= After-tax OPM × Capital or Asset Turnover

Av LT liab, equity includes LT D, Share Capital, Retained Earning

Aggregate measure to gauge firm’s ability to create value across all investment

Comparing to ROR, if ROIC > ROR, 🙂

🙁Accounting, not cash-based method, backward looking

If two mutually exclusive project, can only undertake one

Capital Structure

** ** Calculate WACC: Cost of Debt = int cost (=min ROR) VS Cost of Equity = DDM or CAPM

Cost of Capital (COC): WACC

= (Cost of debt × Weighting of debt) + (Cost of equity × Weighting of equity)

= Cost of financing comp = Opportunity cost of fund for suppliers = Required ROR suppliers of capital require as compensation for capital = measured by Weighted Average CC (WACC)

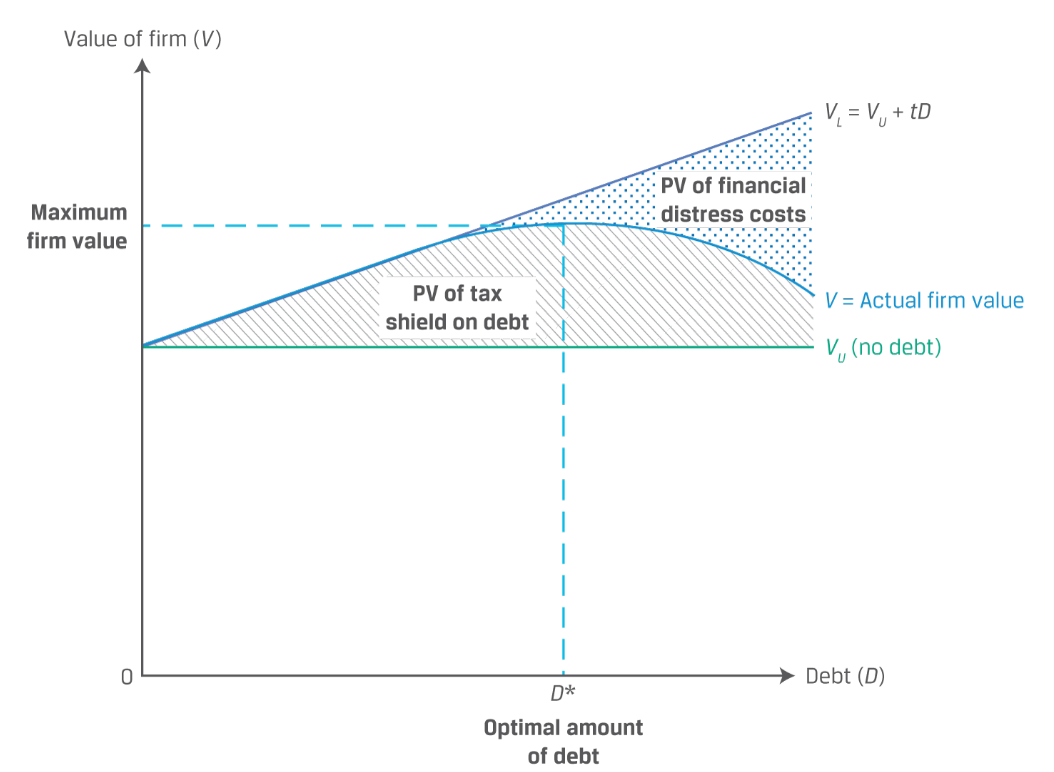

Moldigliani and Miller (MM) Proposition: ??????????????????????

Comp’s choice of capital structure does not affect its value (value = PV of firm’s expected future CF, discounted by its WACC). Future CF is most imp

Assumptions: (1) homogeneous expectations of future earning/CF, (2) Perfect capital market [no tax / transaction cost / bankruptcy cost, symmetric info], (3) RF rate lending / borrowing, (4) No agency cost (5) Independent decisions

V = Market Value

Proposal 1 (w/out tax): Capital Structure Irrelevance:

keep in mind RF lending rate + arbitrage possible,

VL = VU :: Value of levered comp = Value of unlevered comp

Value of comp determined by expected future CF

WACC unaffected by capital structure

Proposal 2 (w/out tax): Higher Financial Leverage Raises the COE:

Proposal 2 (w tax): Firm Value with Taxes:

Profitable company can ↑ value (V) by using debt

↑ tax rate, ↑ benefit of using debt in the capital structure

Proposal 2 (w tax): COC:

Cost of financial distress

VL = VU + tD - PV

D* maximized firm value, Associated equity = optimal capital structure

static trade-off theory of capital structure: ↑ leverage = ↓ firm value, PV of financial distress > tax benefits

↑ business risk. = ↑ Value-reducing impact of financial distress / bankruptcy

Target Capital Structure: mngmnt’s desired D/E proportion, stated in book value / indirectly using financial leverage metric (net or gross debt to EBITDA, credit rating, etc). This is because market value fluctuates substantially, mngmnt’s concern is amount / type of capital investment by comp (not in comp), policies aligned to measure used by 3rd parties

Example:

Pecking Order Theory: Managers, incorporating consumer views, prefer decisions least visible (internal equity) over most visible (equity)

Business Model

Pricing model:

Simple products: (1) Tiered - dif P for each buyer / volume / product feature (2) Dynamic - dif P for time / customer depending on avail supply ie. hotel (3) Value-based - value /effectiveness received by customer ie. pharmaceutical (4) Auction - bidding

Complex products: (1) Bundling (2) Razor, razorblad pricing - low qual P on initial purchase + high margin on its equipment (3) Add-on pricing - optional service ie. league skins

Penetration pricing: lower price to penetrate market

For digital models: (1) Freemium biz model - certain lvls free (2) hidden rev biz model - ads

Alternatives: (1) Subscription (2) Leasing, licensing, franchising

Biz model:

Contract manufacturer: branded products w manufacturers

Value-added reseller: add customization / installation / support

Licensing: use brand for loyalty

Financial Statement Analysis

Financial Reporting Quality:

Earning quality good = sustainable, FS quality good = well represented

Within GAAP (biased choice) > Within Gaap (EM) > Outside Gaap (conservative choice)

Aggressive = higher income bias

Conservative = higher sustainability of earning

Motivation for low qual FS: (1) beat benchmark (2) career or incentive [unexpected biz strength banked for next per]

Condition for low qual FS: (1) opportunity [poor in/external control, min consequence, gov cutbacks on financial regulator] (2) pressure / motivation [bonus] (3) rationalization

Spectrum of Quality:

GAAP, decision-useful, sustainable, adequate return

Principle-conforming, Decision-useful info [= relevance + faithful representation, Enhancing characteristics (= Comparability, verifiability, timeliness, understandability)]

GAAP, decision-useful, unsustainable

GAAP, biased choice (unintentional): Aggressive / conservative accounting, Earning smoothing (underestimate volatility)

GAAP, Earnings mngmnt (EM = intentional)

Non-compliance accounting

Fictitious transaction

FS Quality Discipliners:

Market Regulatory Authorities

Ex. International Organization of Securities Commissions (IOSCO):

Global standard setter for the securities sector [Technically not a regulatory authority and standard setting]. Thus Establishes objectives and principles to guide securities and capital market regulation

Aims to protect investors, ensure a fair / efficient / transparent market, reduce systemic risk

Promotes cross-border cooperation and uniformity in securities regulation

Ex. SEC: Securities / capital market regulator

Statutes enforces include ① Securities Act of 1933 (registration of all public issuance of securities, inform properly), ② Securities Exchange Act of 1934 (create SEC, enforcing periodic reporting and authority over industry), ③ Sarbanes-Oxley Act of 2002 (create Public Companies Accounting Oversight Board, or PCAOB to oversee auditors, addressing auditor independence, enforcing mngmnt / auditor to report effectiveness of internal control)

Regulatory regimes affect FS thru Registration / Disclosure / Auditing requirements, Management commentaries, Responsibility statements, Regulatory review / filing

Standard setting bodies (IASB, FASB): Private sector, self-regulated org w board members as experienced accountants, auditors, academics. Sets standards

Regulatory authorities (SEC): Legally enforce (thru fines, suspending market participants, criminal prosecutions) financial reporting requirements